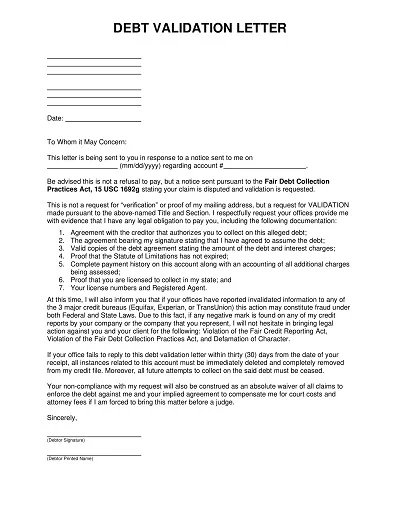

A Debt Validation Letter Template is a special form to provide instructions on how the person called by the collector may formally request verification of the debt in question. It is invoked under the Fair Debt Collection Practices Act, which allows consumers to dispute the genuineness of a debt within one month from the date the debt collector communicates with them.

It generally covers fields for the consumer’s details, the date of the request, details of the collector, and a series of legally constructive questions designed to force the collector to provide proof of the debt, how the amount was arrived at and their ability to collect it. By following such a template, people receive some assurance of legal compliance in possibly disputing or confirming an obligation, thus promoting safety and well-being.

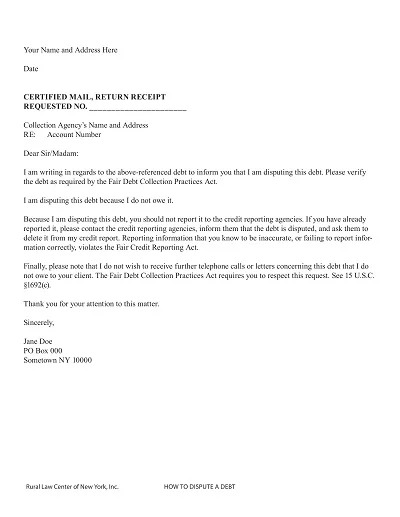

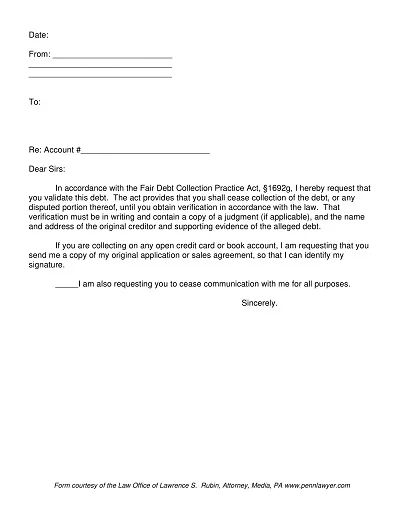

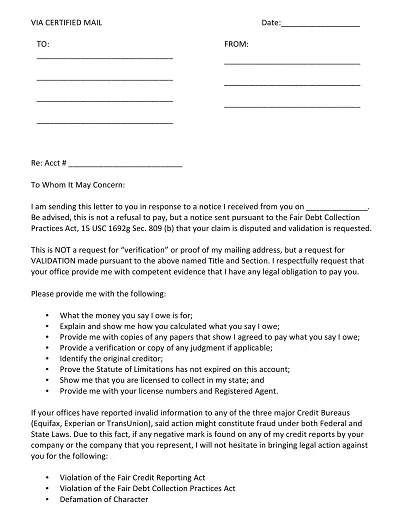

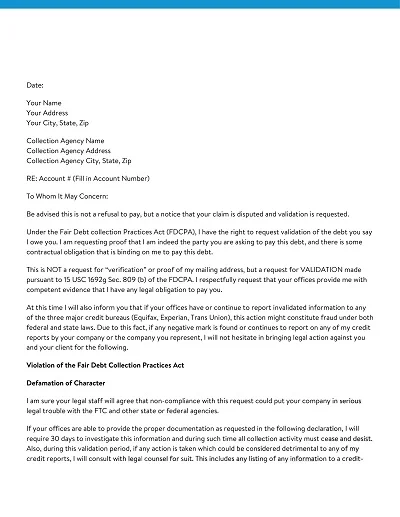

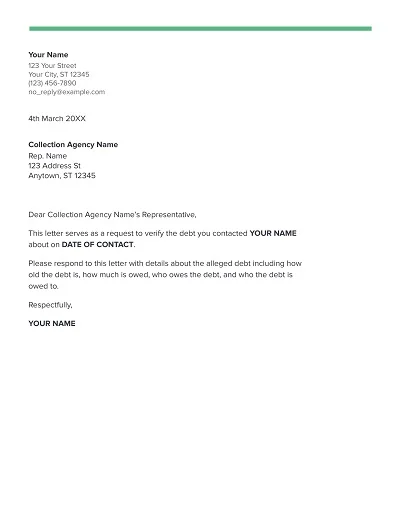

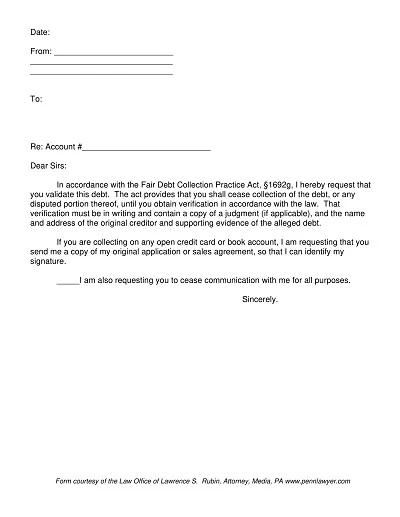

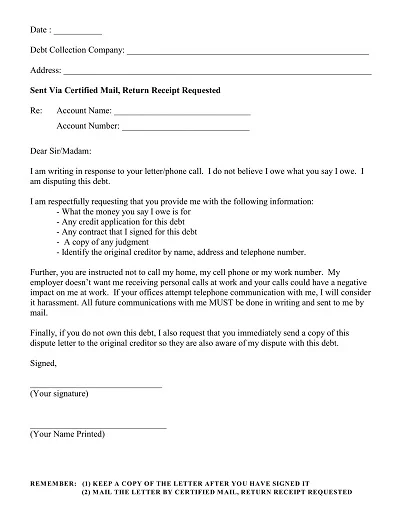

Download Free Simple Debt Validation Letter Templates

What is a Debt Validation Letter?

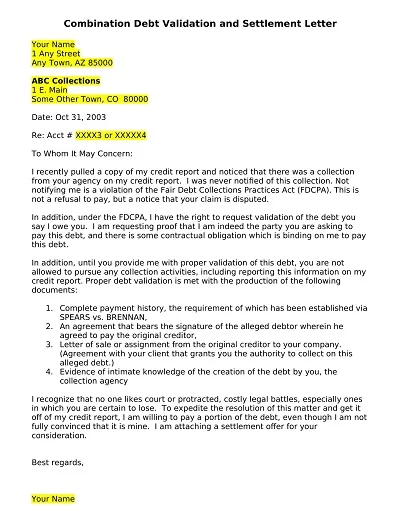

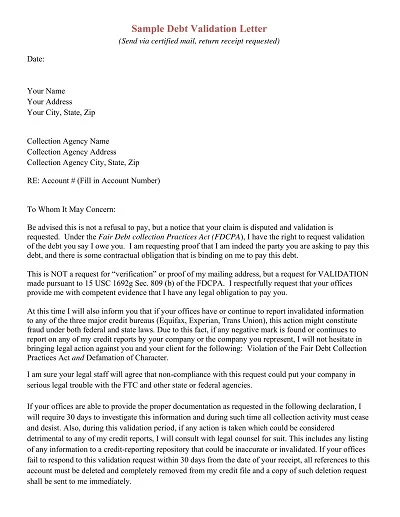

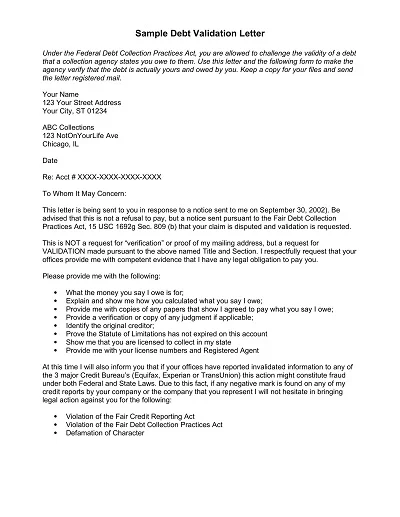

A Debt Validation Letter is one of the consumer’s rights which is provided by the Fair Debt Collection Practices Act (FDCPA) enabling consumers to demand that the collector prove a debt which has been presented by them. This letter is the consumer’s right to dispute the debt’s validity and seek adequate documents to prove that the debt collector is right.

The request can involve claims of the total amount owed, the name of the creditor who sold the debt, and documents that show the debt belongs to the debtor. A debt validation letter is one of the key elements in debt management and verification that allows consumers to safeguard themselves against the illegitimate claims of their creditors.

What Should be in a Debt Validation Letter?

A debt validation letter is an effective tool for anyone seeking to challenge a certain debt or to obtain additional information about it. This letter should include certain key details to ensure its effectiveness:

- Your Full Name and Address: This is to help the debt collector confirm your identity when communicating with you and mailing other correspondences.

- Date of the Letter: To record the date that the request was made regarding the timeline of the validation process.

- The Account Number or Reference Number: This way, the debt collector can easily know which of the debts you are referring to.

- A Statement Requesting Validation of the Debt: It is important to affirm to the creditor that you are demanding proof of the debt and the details of it. It may mean insisting on the debt’s total amount, the original creditor’s identity and any material that the collector might employ to prove that they are entitled to collect this amount.

- A Request for the Original Contract: Request that the creditor provide a copy of the original contract or agreement signed to access credit.

- Dispute Any Inaccuracies: If you feel this is incorrect, kindly explain your stand in detail in the letter. However, elaborateness and proof should be saved for future letters more suited for scholarly debate.

- A Clause Stating Your Understanding of Your Rights: Remind them that you are aware that the FDCPA also guarantees that you cannot be contacted for further details until the debt has been validated.

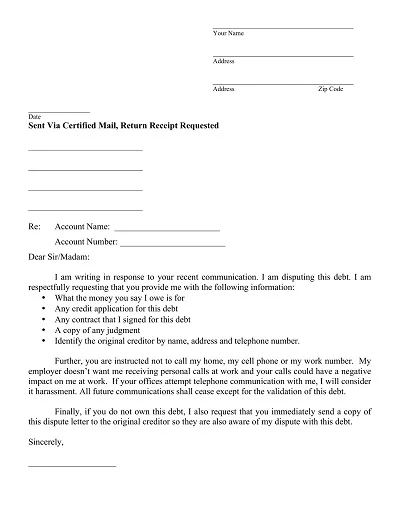

Please note that this letter should be mailed by certified mail with a request for a return receipt to prove it was received.

Why Is a Debt Validation Letter Important?

A Debt Validation Letter is an important document in the financial market because it functions as a demand from a consumer for verification of the debt claimed by a creditor or a collection agency. This letter is important because it transfers the burden of proof on the part of the collector to prove that the debt is valid, the amount is correct, and that they are within their right to collect.

It is not only a chance for the consumer to avoid paying for an inaccurate or fraudulent claim. Still, it is a legal mechanism that helps the consumer record the validation request. This may be especially important in contentious issues or if the issue is taken to the relevant authorities. In other words, a Debt Validation Letter educates and safeguards the consumers financially while underlining the relevance and use of consumer assertiveness in the case of debt collection.

How to Use a Debt Validation Letter

So, a Debt Validation Letter is not just a piece of paper but a powerful weapon in your collection arsenal. Here’s how to leverage it effectively:

1. Gather Your Documents

To support your letter, gather all related documents like statements, prior communications with the creditor, and proof of payment. This will assist you in making the right reference to the debt and determining the validity of the collector’s assertions.

2. Draft Your Letter Carefully

This letter should, therefore, bear professional language and be free from complicated terms as much as possible. Cite the sections of the FDCPA that apply to the validation of debts. It shows that you are informed of your rights, which may lead to a more elaborate evaluation from the debt collector.

3. Keep Copies of Everything

There is another rule: It is important to take paper documents. It is recommended that you also retain a copy of the letter and any enclosures that have been sent out. Also, keep a copy of the certified mail receipt and the return receipt when it returns to you. This documentation should serve as your proof of endeavour to confirm the existence of the debt.

4. Await the Collector’s Response

According to the law, a debt collector is required to meet your request to verify the debt or stop any collection activity altogether. If they validate the debt, check your paperwork and see if it matches what they displayed. If the information differs or if the collector does not answer, you may have the right to claim additional details.

5. Next Steps Post-Validation

After that validation confirmation, you are left in a position where you have to make some decisions. It might be a payment arrangement or continuing to challenge the debt further if you think the validation is insufficient. If you are not wholly sold on the collector’s evidence, you may seek legal advice from a consumer rights lawyer.

When to Send a Debt Validation Letter

A Debt Validation Letter should be written and sent immediately upon receipt of a notice from a debt collector stating that he is collecting debts from you. This letter should preferably be sent within the first 30 days of the first communication with the recipient.

This timing is important because, based on the Fair Debt Collection Practices Act (FDCPA), one is limited to 30 days from the initial communication to demand that the credit collector verifies the debt. Sending this letter within this period puts the collector under some duty to substantiate the claim that the debt is yours and that they are legally entitled to collect it. It effectively halts collection attempts until the debt is confirmed, providing you with the time necessary to determine whether the amount owed to the creditor is legitimate or not.

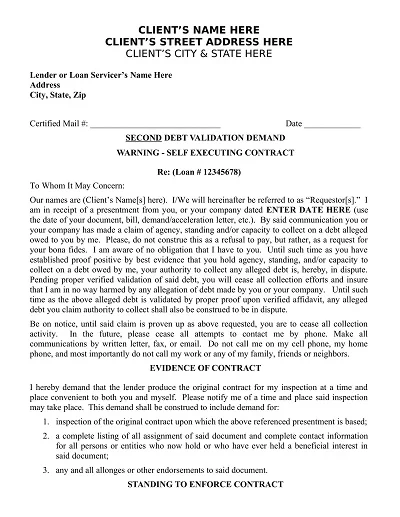

How to Write a Debt Validation Letter Template

Debt validation is a critical process that any debtor or borrower should undertake to determine that the amount a collection agency claims you owe is correct and belongs to you.

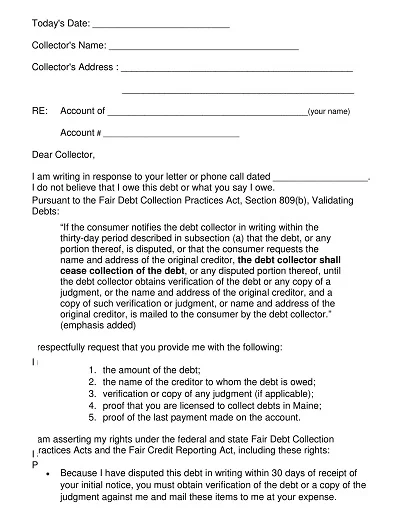

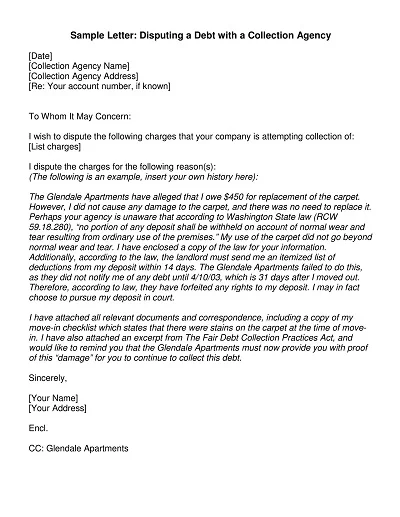

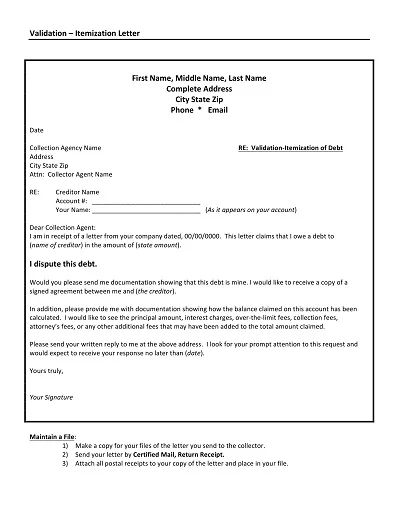

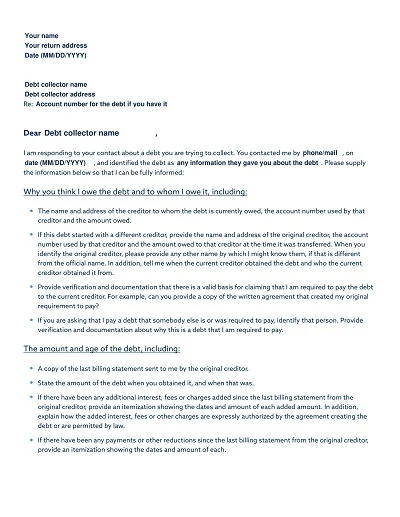

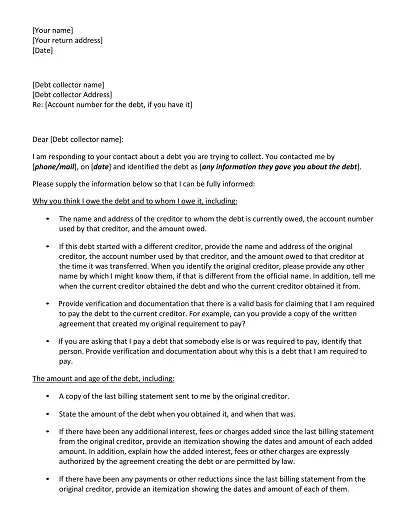

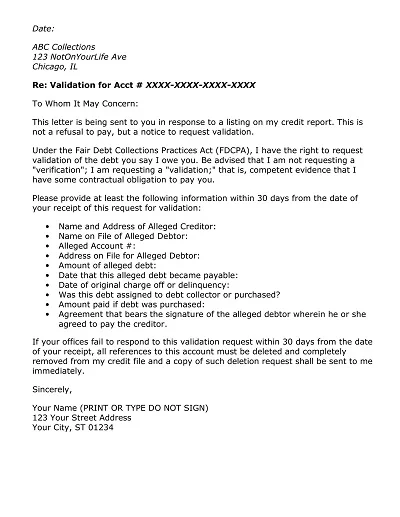

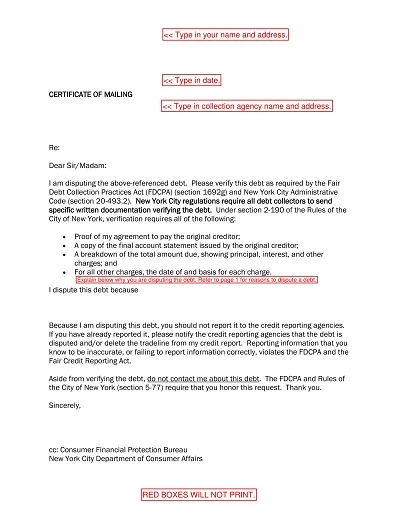

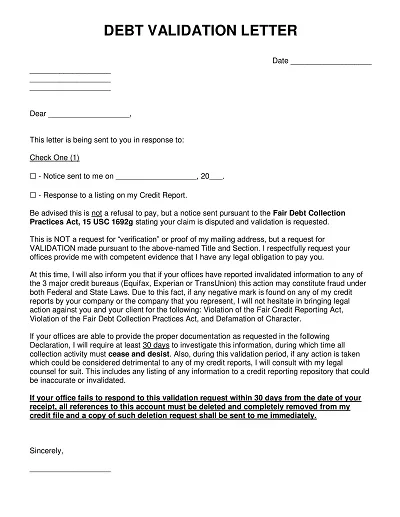

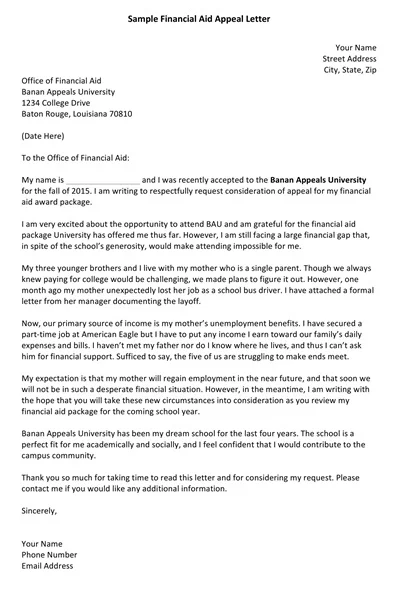

Below is a template guideline for writing an effective debt validation letter:

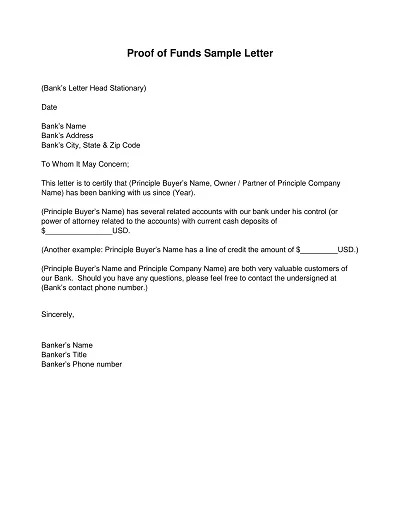

- Header Information: Start with your name, address and date in the upper left corner of the page. Below that, write the collection agency’s name and address in the format:

- Account Reference: When beginning the body of the letter, reference the account or reference number provided by the collection agency for the alleged amount owed.

- Statement of Request: It is crucial to ensure that you specify that you are writing in response to an invitation to pay the amount of money the agency says you owe. State that this request is being made under the Fair Debt Collection Practices Act (FDCPA) provisions, if applicable.

- Details to Validate: When communicating with the said collection agency, the following details should be requested:

- The total of the given debt.

- Name of the prior creditor with whom the buyer of the claim had an unfavourable transaction.

- Photocopy of the original invoice or any written agreement which indicates you are the rightful owner of the debt.

- A breakdown of the debt calculation, with any fees identified.

- Proof that the collection agency is duly registered to collect debt in your state.

- Cease Communication Clause: Remind the collection agency that until it proves the debt’s validity, you require them to stop contacting you in any way that violates the FDCPA.

- Closing: Conclude this letter by describing that, following the law, an answer must be submitted within thirty days of receiving this letter. Applaud the agency for their…

- Signature: End the letter using the phrase “Sincerely,” and then sign your name in cursive below the phrase, followed by your typed name.

It is also important to remember to mail the letter certified with a request for the return receipt to confirm the delivery of the letter.