A Mortgage Agreement Template offers a format of the legal requirements when a loan is offered under the assistance of a piece of property. This has the general legal structure that both the lenders and the borrowers can use the template to make the agreements formal and, therefore, reduce party risks since loan amount, interest rate, repayment plans and penalties in case of default are outlined.

Preparing mortgage agreements implies using a template, which greatly facilitates the paperwork, eliminates drafting issues and ensures compliance with the required norms. It helps both parties to understand each other and to get rights to the property that one Gives as security for the other.

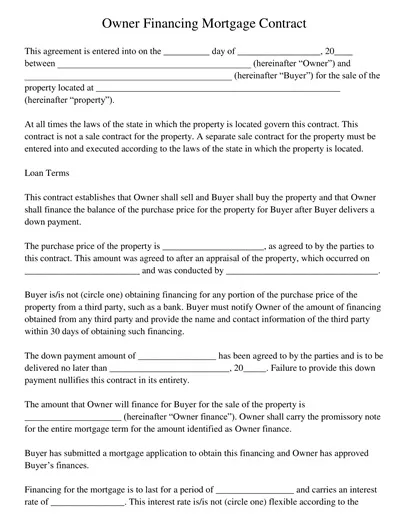

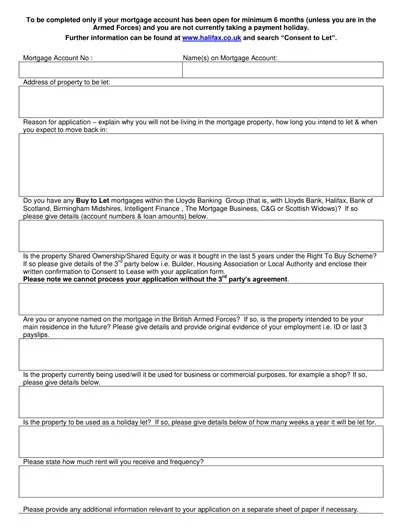

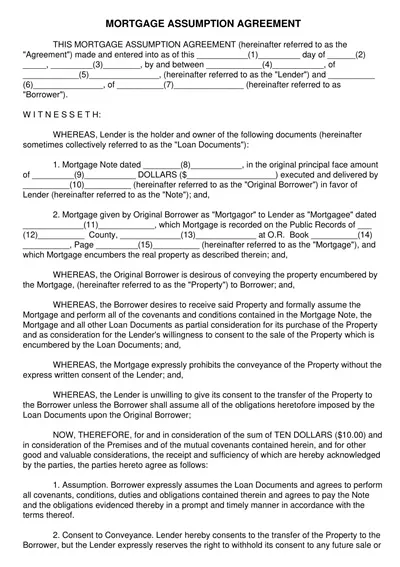

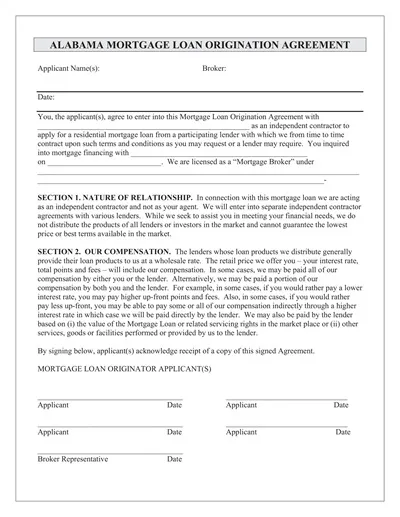

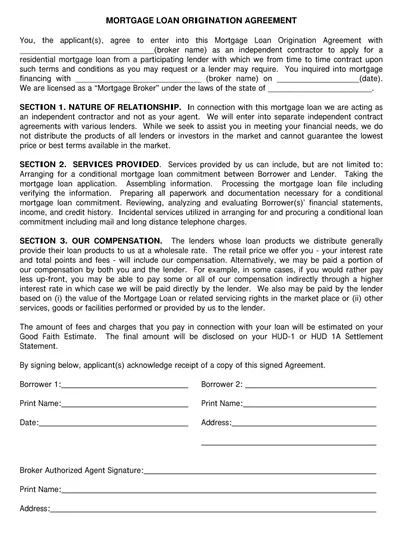

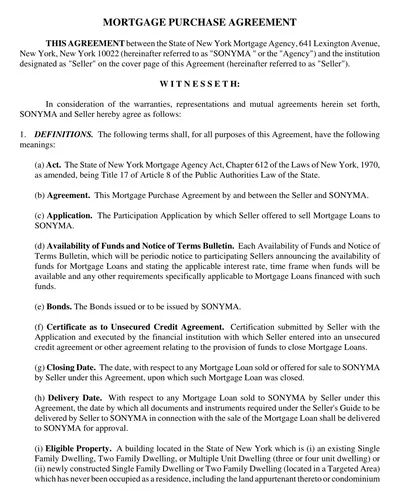

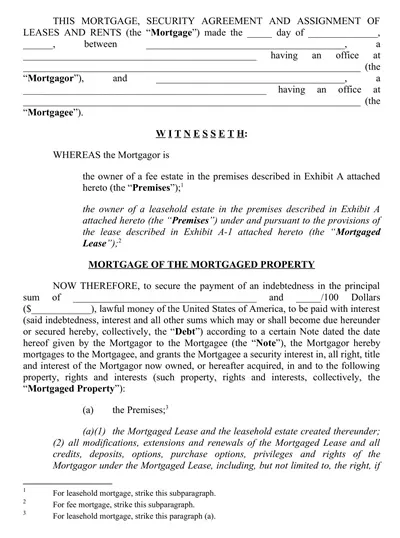

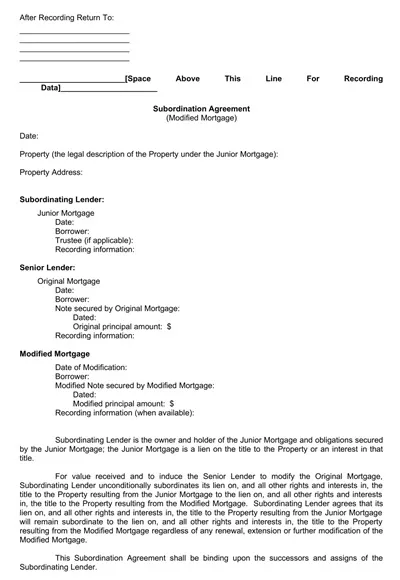

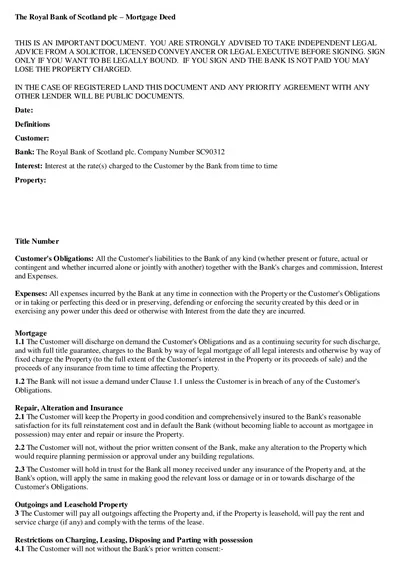

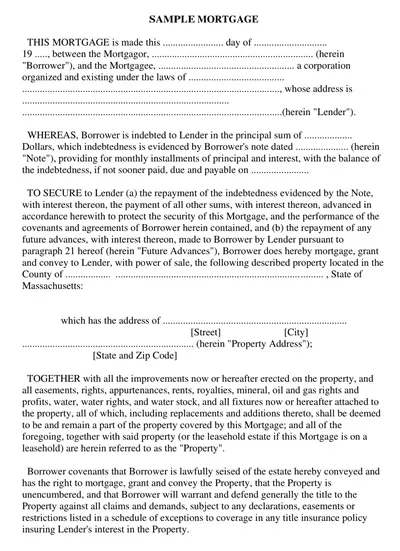

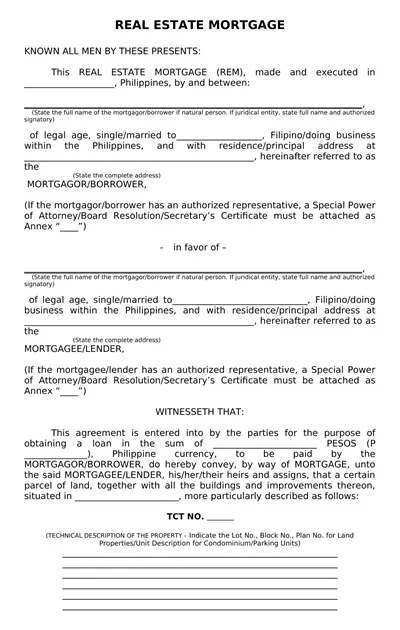

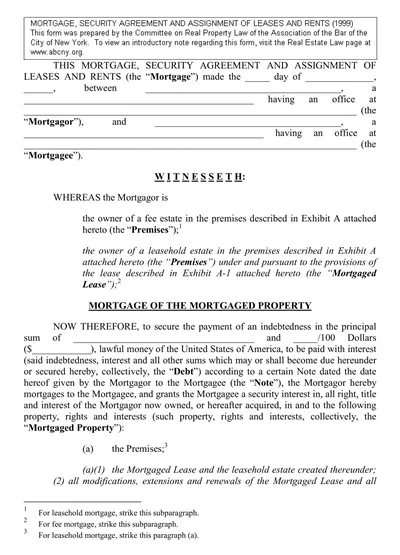

Download Free Sample Mortgage Agreement Templates

What is a Mortgage Agreement?

A mortgage is an agreement under which the mortgagor/borrower provides real property as security for the liabilities owed to the mortgagee/lender. This also shows how the borrower will repay the loan and the duties of the two parties. Among those that are usually offered include the amount of principal credit, rate of interest, terms of payment and repercussions in case of failure to pay or early payout.

Like in other kinds of security, mortgage agreements safeguard the interests of givers while takers have a straightforward method of accessing funds for acquiring or refinancing properties. In addition, everybody would benefit from this kind of agreement as it outlines how both firms would relate to the property under mortgage regarding their rights and obligations.

Types of Mortgage Agreements

There is nothing special about mortgage contracts as they differ depending on the type of mortgage and the needs of both the giver and taker. Some of the most common types of mortgage agreements include:

1. Fixed-Rate Mortgage

This type of mortgage has its interest rate determined at the time of loan issue, and it remains constant throughout the length of time provided by the loan. It presents security to those who squeeze okay with regular monthly payments without the hassle of variable interest.

2. Adjustable-Rate Mortgage (ARM)

Unlike a traditional APR or adjustable periodic rate, an ARM has an interest rate that adjusts periodically. However, its initial interest rate may be lower than that of other loan options; however, it steadily rises as the years or months pass, hence affecting the monthly payments.

3. Interest-Only Mortgage

This contract allows borrowers to pay only interest for a certain period, and after this period, they need to pay the principal sum. It would be advantageous for individuals with anticipated raises in pay or for those who prefer to invest the payment difference.

4. Balloon Mortgage

The balloon mortgage program implies that one pays a limited amount of the loan balance over some time, and the remaining balance is paid at one time. It is suited to borrowers who intend to sell or alter the home before the payment of the balloon amount.

5. Government-Backed Mortgages

This type of mortgage is guaranteed by the government, and it is designed for some categories, such as veterans who have had VA loans while those with FHA loans are first-time homeowners. It generally has a better contractual bargain than the usual home loan.

Every kind of mortgage contract contains strengths and weaknesses. Consequently, consumers who are involved in accessing the mortgage facilities should further assist themselves in the pertinent type of mortgage that is most appropriate for their financial capacity and needs in the long run.

Key Components of a Mortgage Agreement

Before engaging in a mortgage, it becomes important to consider the foundational parts that define the structure of the agreement to be made between the two parties. These components typically include:

- Principal Loan Amount: The sum that the lender provides to the borrower at the beginning of receiving the mortgage, which should be repaid within the agreed period.

- Interest Rate: The interest rate of the principal amount borrowed, which is assessed as a percentage. It could either be fixed or variable, depending on its implications for the actual payment amounts.

- Repayment Term: The number of months or overall years it is anticipated for the borrower to make the reimbursement of the amount borrowed. Amortization periods for conventional mortgages can be anything between fifteen and thirty years.

- Monthly Payments: The fixed amount that is prearranged between the borrower and the lender, in addition to the main amount and interest which the former has to pay periodically.

- Amortization Schedule: A detail of the sharing of every payment between the principal and the interest for the whole period of the loan.

- Collateral Description: The legal identification of the property to be mortgaged and its size and situ.

- Taxes and Insurance Requirements: Responsibilities concerning payment of property taxes and Homeowner’s Insurance, which must be paid monthly through an Escrow account as part of the monthly mortgage payment.

- Late Payment Penalties: Further information concerning the impact that failure to make the agreed payments on time will have on the company, either through additional charges or a higher interest rate.

- Default Clauses: For example, conditions that determine what makes up default and any legal proceedings that may be taken within the lending process, such as foreclosure.

- Prepayment Penalties: Fines are typically claimed when the mortgage is paid ahead of the time set by the mortgage agreement.

Each of them reflects a special importance in defining the activities and obligations of both the lender and the borrower under the contract; in other words, they define the further trajectory of the contract with sufficient accuracy and clarity.

Benefits of a Mortgage Agreement

A mortgage agreement has the following advantages, contributing to stable and non-ambiguous execution of transactions by the mortgage parties: The major benefit for the borrowers comes with the fact that they are able to acquire property that they could not afford on the face value.

This makes the ownership of the house to become becoming easier, especially so to those with little cash to save. Mortgage agreements also offer the borrowers structured repayment packages to enable the legal framers to plan their monthly instalments in accordance with the loan period, which is between fifteen and thirty years.

From the lender’s perspective, a mortgage contract is a safe way to put money into as a form of investment. Laying down these policies and standards checks the lender’s aspect since it is a security for the loan granted out and the property. As to credit risk, lenders can seize the collateral in event of default thereby protecting their financial interests.

Not less important is the fact that when both parties conform to the terms and conditions of the mortgage agreement, the relationship between them is friendly, and they do not consider the legal trial as the only solution in case of any disagreement. These agreements also follow the legal prescriptions of the state and federal laws; this further adds the external features amounting to transactional security and legitimacy.

How to Create a Mortgage Agreement Template

Drawing a mortgage agreement requires ensuring that records are well-labelled and well-coordinated, as well as a good understanding of the components of the agreement.

Below are the detailed steps to design an effective mortgage agreement template:

- Identify the Purpose and Scope: First, it is important to provide background on what the mortgage agreement template is all about. It is necessary to decide for which types of mortgages it will be used and in what situations. There are both fixed and adjustable-rate mortgages, and then there are factors unique to government loan programs.

- Gather Legal Requirements: In understanding the federal and state legal analysis of mortgages, one is supposed to search for the regulations of the agreements. This, in turn, includes Interest rate terms, foreclosure terms, and mandatory disclosure terms. This helps to make the template not only legal but also one that does not miss some really key pertinent points.

- Draft the Basic Information Section: It starts the structure with blocks for the borrower’s main information and blocks for the lender’s main information. This should contain name and address fields as well as phone number fields and date of agreement fields. This section provides clear groundwork for defining the players involved.

- Define the Loan Details: The key characteristics of a loan predominantly relate to the sum of money, rate of interest and repletion rate. It is possible to have special fields to indicate whether the interest rate is fixed or variable and the place for the detailed Amortization table. This part sets out the financial pro forma of the project to provide the framework for funding.

- Outline Payment Terms: As for payment and essential information about payments, it would be useful to explain the subdivisions in more detail, including concerning the information necessary for the consumer: monthly payments, the due dates, and permissible means of payment. As with any common contract terms, it should also contain the clauses on pagar, or payment and late payment penalties. These skylines provide post-January certainty to prevent further controversies.

- Include Collateral Description: Include a legal description of the property and its location and/or a legal description of its boundaries. This is done in a bid to make sure the two parties have the rightly right understanding of the asset given as security for the loan.

- Detail Taxes, Insurance, and Escrow: Also, be certain to include the following that should highlight the expectations regarding the property taxes and insurance payments. If any of these are to be dealt with through an escrow account, include all details and conditions for its use.

- Add Default and Prepayment Clauses: Evidently, define the circumstances under which the agreement can be in default and also define other repercussions such as foreclosure processes. Additionally, one should explain any prepayment penalty or advantage since it might be necessary to disclose such in the balance sheet.

- Verify and Finalize the Template: After you finish the above process, get the template reviewed by a lawyer for its compliance and omission. Modify it as may be required and prepare regular updates that will enable the preparation for new legislation, revisions, or trends in the mortgage business.

- Provide Instructions for Use: Last of all, provide a user guide or guide on how to fill the template, an explanation of the terms used, and a list of areas that may require user input in each agreement under the template. This makes the template more flexible to use and, as such, meets the user’s needs.

In such a way, you can develop a strong template for the mortgage agreement that complies with legal demands and offers a clear strategy for real estate securitization.