An owner finance contract template can be defined as a legal document that captures the legal relations of a transaction in which a seller offers an option of financing the sale of a particular property. Unlike some forms of business funding, it does not take bank financing; instead, the seller acts more like a creditor.

The template also captures all payments extended to the buyer and other aspects like the rates of interest charged, the period within which the loan is repayable, and any other terms considered between the buyer and seller. Protecting the buyer and selling parties equally helps to avoid or minimize either party’s confusion regarding the financial transaction.

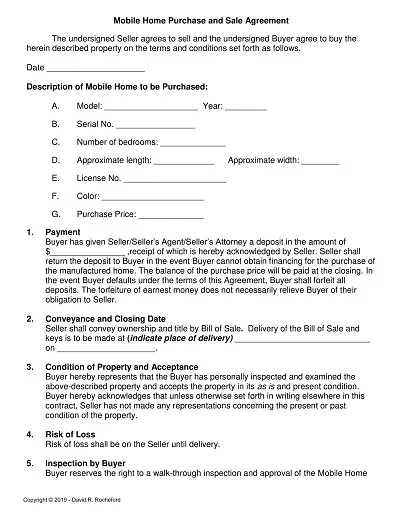

Download Free Simple Owner Finance Contract Templates

What is an Owner Finance Contract?

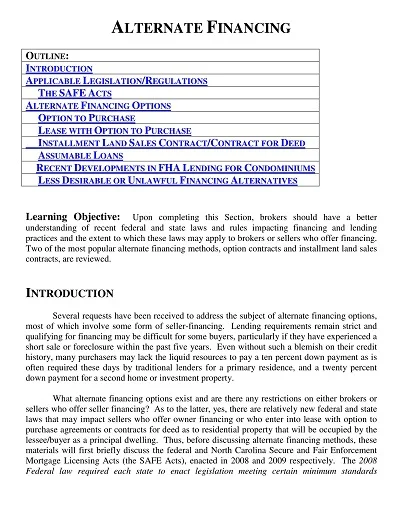

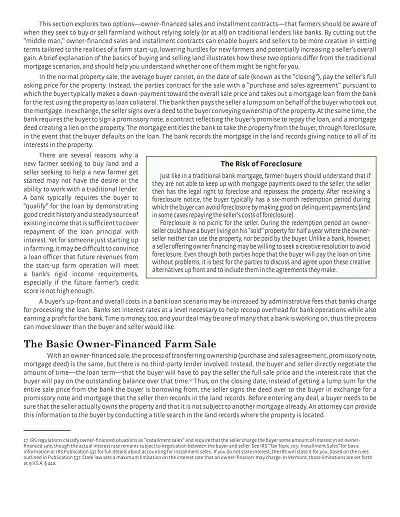

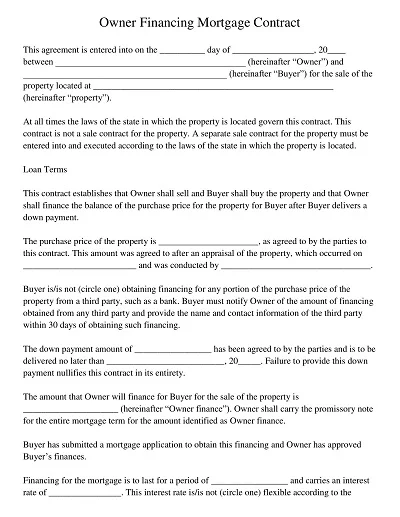

An Owner Finance Contract, also known as seller financing or a purchase-money mortgage, is a legal agreement between a property buyer and a seller in which the latter agrees to provide the necessary funds to acquire property.

Financing whereby instead of lenders advancing the money to the buyer to pay for the property, the buyer will pay the seller the cost of the house and any interest through installments. This may also work to the advantage of buyers who cannot afford to put down deposits to take standard commercial loans and sellers who wish to offload properties quickly.

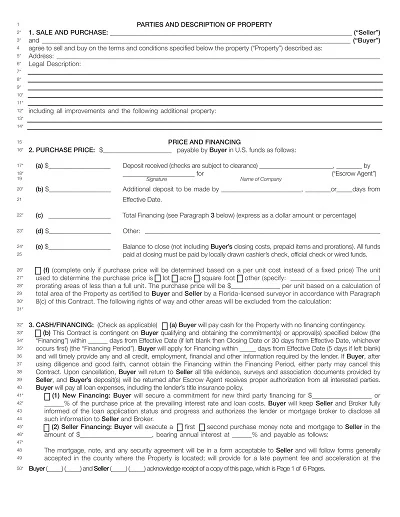

Critical Components of an Owner Finance Contract

Critical components of an owner finance contract include:

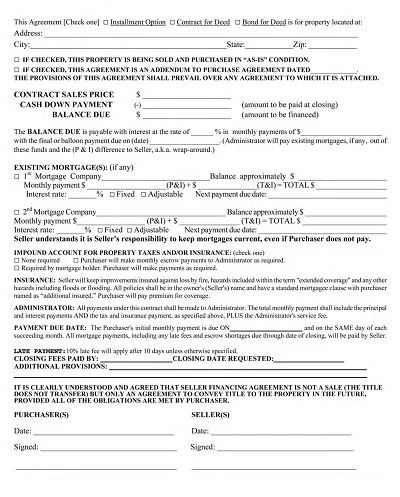

- Purchase Price: This is the defined price comparing the property offered for sale between the buyer and the seller.

- Down Payment: An immediate payment made by the buyer to the seller at the time of purchase of products. Generally, it is paid as a percentage of the total purchase cost.

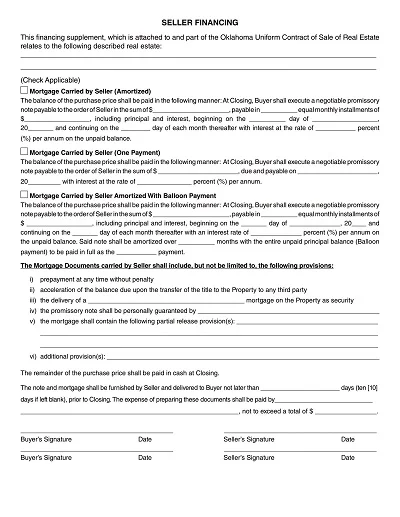

- Interest Rate: The frequency within which the buyer consents to incur more interest charges over the unpaid balance.

- Repayment Plan: The payment details, including the frequency and amount of payments, and the loan term are also discussed.

- Default Consequences: This section outlines countermeasures that may be employed if the buyer refuses to pay by the agreed-upon contract.

- Transfer of Ownership: This document explains who will convey the property title and when the process will be completed.

What Is Covered in An Owner Financing Contract?

Some options in an Owner Financing Contract include the sale price, interest rate, mode of repayment, down payment, the consequence of defaulting on the deal, and both the owner-financing and the borrowing business’s responsibilities.

Under this, it contains clauses describing the property and both parties’ insurance and tax responsibilities; further, it includes all legal requirements concerning the state of the property or its usage.

Moreover, various contracts contain due-on-sale clauses, calling for immediate payment of the total loan balance if the property is sold with acceleration clauses, which enable full repayment based on specific terms. As a complete legal document, it is considered to safeguard the financier’s and buyer/seller’s interests during financing.

Advantages and Disadvantages of Owner Financing Contracts?

Another standard method of property purchasing and financing is owner financing or seller financing, in which the seller offers credit assistance to the buyer. Such a structure may prove beneficial and unfavorable to providers and users in the following manners.

Advantages of Owner Financing Contracts

- For Sellers:

- Higher Selling Price: This is mainly because of the relative ease and the one-off opportunity for the buyer; sellers typically get a better price for their property.

- Faster Sale Process: According to the financing offer, more buyers will ensure the sales increase; hence, they sell faster.

- Continuous Income Stream: The recipient is afforded monthly installments that can finance him or her throughout the loan period.

- For Buyers:

- Easier Qualification: Owner financing is favorable to buyers because even if they cannot qualify for bank financial help to buy a home, they can still apply for owner financing.

- Flexible Terms: An owner-financing deal can be reached depending on the buyer and seller’s financial capacity and well-being.

- Quicker Closing Process: Procurement can be much faster when not involving the multiple requirements of standard bank loans.

Disadvantages of Owner Financing Contracts

- For Sellers:

- Default Risk: The legal process of recovering the asset entails the seller repossessing the asset sold by exercising his/her legal rights if the buyer fails to service the loan(full; legal; exhaustive).

- Opportunity Cost: Also, the payment structure enables the buyer to make payments gradually, meaning the seller might have limited ability to invest the sale proceeds to higher yielding opportunities.

- For Buyers:

- Higher Interest Rates: Funds through owner financing are expensive compared to conventional lending methods such as bank loans.

- Large Down Payment: The use of a down payment may be that the sellers would want to attach a higher down payment due to risks in case the buyer defaults.

- Short-term Loans with Balloon Payments: Some common characteristics of owner financing are that they are often structured as an interest-bearing note; the buyer pays the remaining balance in a single payment at the end of a short term with little or no down payment.

When Should You Use The Owner Financing Contract?

Owner-financed can be considered a feasible formula for both buyers and sellers in real estate transactions in some ways. As for the audience, it is more advantageous than other lending approaches for those who might face specific difficulties using conventional means.

For Buyers:

- Credit Challenges: If you have a weak credit score or a past financial capability that rules out a Mortgage, Owner financing opens the door to owning a home.

- Self-Employed Individuals: Self-employed individuals or those with low incomes and irregular earnings may find it difficult to get bank loans. Owner financing is much more favorable to the buyer as a credit supply since it practically eliminates the need to prove income.

- Unique Property Types: At times, properties that may not be easily financed through FHA or conventional loans, like mixed-use properties, are easier to obtain through owner financing.

For Sellers:

- Market Conditions: In a slow real estate market, a buyer would be more interested in a property with the bonus of owner financing. Such a financing option is rare, therefore increasing the number of potential buyers.

- Investment Strategy: While using owner financing can be a good investment plan, the sellers might find it better to accept a long-term monthly payment that will assure them of getting a steady income in some years, depending on the interest rate that has been agreed on.

- Property Challenges: If the property is not salable due to some factors or challenges, selling it using standard methods may be challenging. Owner financing will add value to the property.

Owner financing provides a versatile solution to buyer-seller relationships with problems in the conventional real estate sector; rewards from selling a home through owner financing depend on circumstances.

How to Create a Owner Finance Contract Template

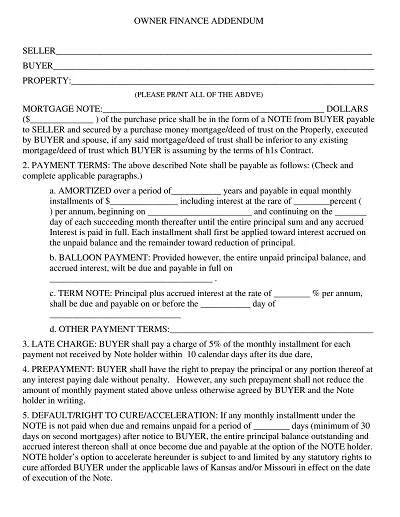

Owner financing can be defined as a contract that enables an owner to finance a property’s purchase voluntarily. Below are the detailed steps and components that will guide you in assembling a comprehensive template:

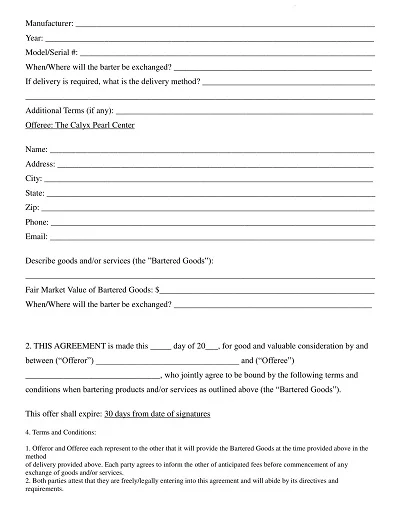

1. Introduction Section

- Purpose: It is also essential to indicate the reason for drafting the agreement, which should be based on the interests of every party in the transaction.

- Identify Parties: Pray list all parties with full names and addresses. Define the role of the seller, who acts as the financer, and the role of the buyer.

2. Property Information

- Address and Description: Include the full physical address with the specific coordinates and a legal description of the site with the geographic coordinates.

- Identification: When using other identifiers, such as lot or parcel numbers, include them in the same list.

3. Financial Terms

- Sale Price: Record the cost that you incurred to buy an asset.

- Down Payment: When you buy a car, you need to set down how much down payment you will be willing to pay.

- Loan Details: Make sure to record the amount of the loan, the interest rate applied to the loan, the period of loan repayment, and the monthly installments.

- Payment Schedule: Specify the due dates of all payments.

4. Buyer’s Obligations

- Insurance: What is meant by property insurance?

- Taxes: Enumerate who bears the responsibility of property taxes.

- Maintenance: Substantiate the expectation that we will keep the property’s exterior in good shape.

5. Default and Resolution Mechanisms

- Definition of Default: Explain the circumstances that can be interpreted as the borrower’s failure to meet the loan’s obligations.

- Seller’s Remedies: What measures can the seller take if the buyer fails to make payment for the commodity or violates the agreed terms, such as repossessing the goods or approaching the law?

6. Compliance with Law

- Legalities: Ensure that the contract does not violate any federal, state, or local laws in the country or state where you operate.

- Required Disclosures: List any legal disclaimers /loopholes or necessary checkups needed to be done.

7. Execution of the Contract

- Signatories: Give ample areas to sign on from all the parties and possibly witnesses or the notary in case of legalization.

Please note, and importantly, one should seek the legal services of a legal practitioner to prepare and draft the contract to meet legal drafting standards and other legal necessities of the country.