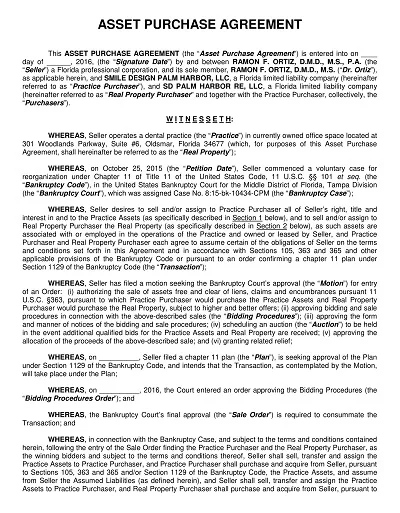

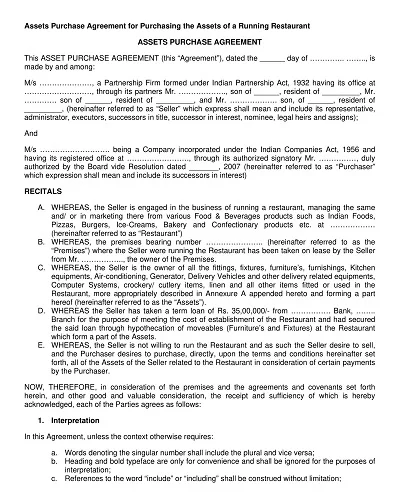

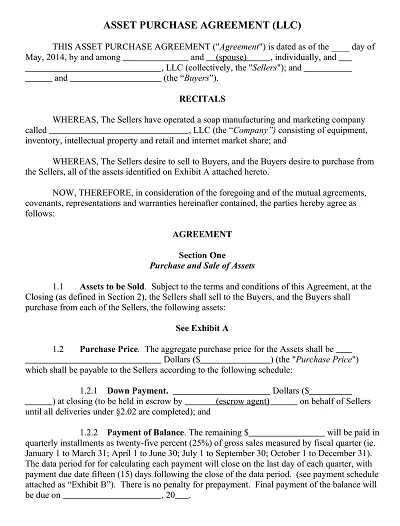

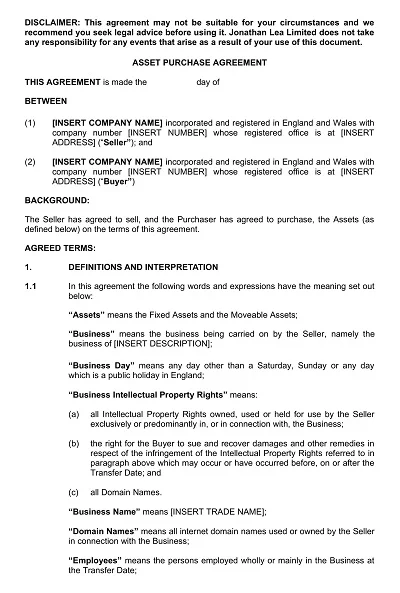

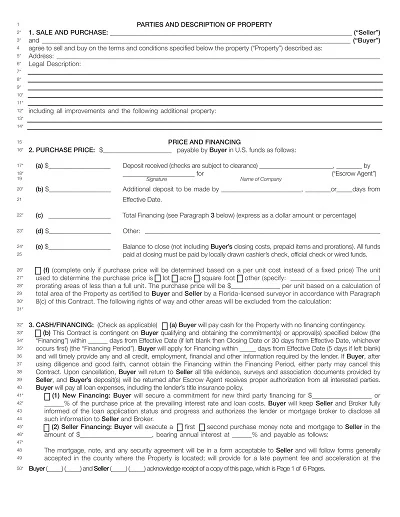

An asset purchase agreement is a contractual document that outlines the nature of the structure and contains terms on the purchase and sale of your company’s assets. This template presents a skeleton of details concerning what is included in the appendix to the agreement, the purchase price, any contingent liabilities that the buyer will pick up, and the representations and warranties given by both parties and covenants of each party.

Since it provides all the parties with knowledge of each party’s responsibilities and the general setting of the transaction, it benefits all parties. The process is beneficial in business transactions, especially during business purchases, because it enables the buyer to get an accurate picture of the business and the price paid for that business.

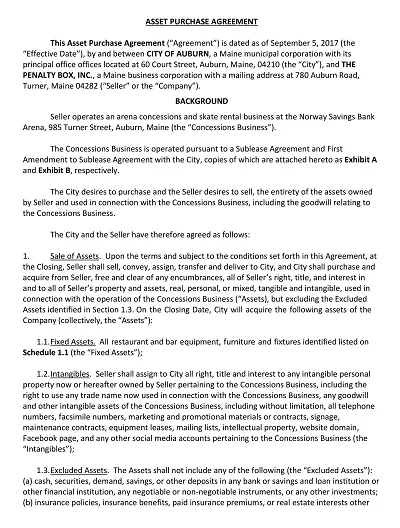

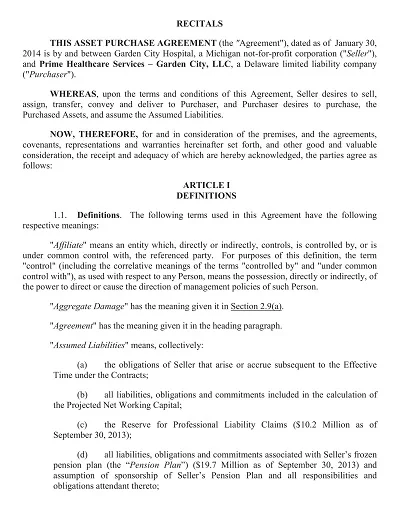

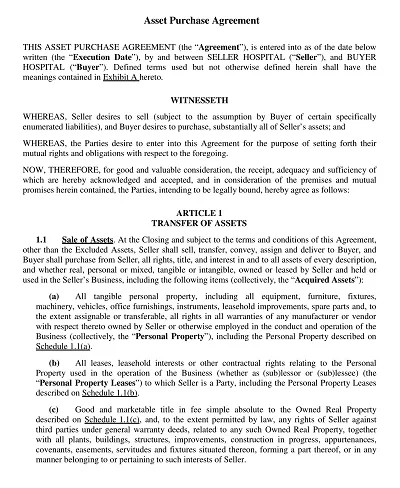

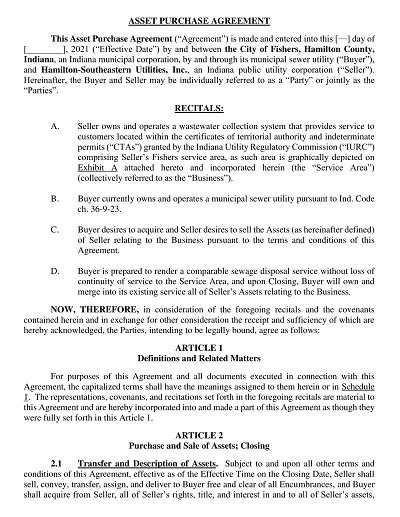

Download Free Simple Asset Purchase Agreement Templates

What is an Asset Purchase Agreement?

In simple terms, an Asset Purchase Agreement (APA) is a legal contract signed between the purchaser of an identified business and the seller concerning the availability for sale of some specific assets. This kind of agreement is usually popular every time the business person plans to sell only some of the properties of the business.

The APA also lets in which kind of asset is being disposed of, whether it is a fixed tangible asset in the form of land and equipment or even a fixed intangible asset in the form of trademarks and patents. Another is taking liability for certain risks by the buyer, the price to be paid to the seller, and the change in such price regarding inventory or accounts receivable that is subject to change.

Importance of Asset Purchase Agreement for Small Businesses

Here are some Important Asset Purchase Agreements for Small Businesses:

Preservation of Buyer and Seller interest

This implies that the AP is the most basic mechanism that spells down the relations between the two traders in a way that safeguards each party’s interests in the transaction. In that aspect, small businesses establish legislation that protects them from future disagreements or misunderstandings regarding ownership.

Clarifying the Goals for the Changed Ownership

An asset purchase agreement is helpful because it promotes certainty; the purchaser is aware of specific assets such as equipment, inventory, or intellectual property that make up the property to be sold and specific liabilities attached to the seller.

Tax Considerations

Several tax considerations may arise in an asset purchase, which can be negotiated and managed by the small business in the best way s regarding their tax liabilities about the acquired assets.

Compliance with Laws and Regulations

The Sheriff becomes an enforcement mechanism given that all asset transfer factors must comply with the laws and regulations, which is critical for business entities that may lack in-depth legal knowledge and experience.

Facilitating Smooth Business Transition

Most small businesses want their business to continue indefinitely, no matter what happens. The asset purchase agreement tracks the process of purchasing the assets and operations necessary for a seamless transfer to the buyer while having limited inconvenience to the business and its customers.

Critical Components of an Asset Purchase Agreement

An Asset Purchase Agreement (APA) is a legally significant business document that stipulates the freedom of a buyer to acquire selected assets from the seller.

Critical components of an APA include:

- Identification of Assets: This section gives a breakdown of the assets requisite for purchase, which may include fixed assets, inventory, etc., and also non–fixed assets like patents, trademarks, customers’ list, etc.

- Purchase Price: Sets out the asset price, the payment rationale, and the payment method, which may be up-front, through installments, or even through earn-out methods.

- Representations and Warranties: Each party gives certain representations concerning its power to make and enter into the agreement, the condition of the asset, and the seller’s business.

- Covenants: Third, there are expressions of undertakings to do or not to do certain things before and after the transaction’s closing: for instance, the undertaking to conduct the business in the usual manner before closing.

- Indemnification: Embodies provisions for recovery from loss in case certain representations and warranties are breached.

- Conditions Precedent to Closing: Describes circumstances when some conditions must be met for the transaction to be completed, which may take a lawyer’s approval or the approvals of other entities.

- Termination: Explains the type of situations under which the agreement can be terminated and the effects of such termination.

- Closing and Post-Closing: Details of how the titles will be conveyed and all other closing procedures and obligations after the closing, such as transfer of customers or services contracts.

Advantages of an Asset Purchase Agreement

Outlining some of the benefits of Asset Purchase Agreements or APAs for sellers and buyers in a business transaction will be pertinent.

These include:

Targeted Acquisitions

These parties can be more or less specific on the nature of the balance sheet assets and liabilities they are interested in. This facilitates control over investments and ensures that the buyers do not end up with additional liabilities they may not have desired.

Tax Benefits

The tax benefits that companies can provide to buyers include the opportunity to carry out an application for an increased basis for the purchased assets and, accordingly, higher than the current market value of the item, which will entail a greater rate of tax and deductible costs in the future.

Due Diligence

In the case of APAs, the due diligence may be more detailed because each asset is considered separately, and there is a view of what is being bought and what implications exist.

Flexibility

APAs boast of flexibility when it comes to configuring the deal to suit each party’s requirements and objectives and those of time-saving, which may involve spreading the purchase over some time.

Reduced Liability

Customers do not thus get to bear the risks of legal actions or related litigation risks, previous legal entanglements regarding contracts, etc., which one is likely to get when purchasing the whole entity.

Tips for Using an Asset Purchase Agreement Template

When using an asset purchase agreement template, consider the following tips to ensure accuracy and legal effectiveness:

- Customize for Specific Needs: However, one should always avoid using the template as it is but adjust it according to specific transaction details. Be sure to present all tangible and intangible properties like machinery, supplies, and patents and licenses.

- Clarify Asset Valuation: Specify the value of the assets in terms of the procedures that the agreement has placed in a contract to liberalize. This may include the method for arriving at the appraisal or the amounts the parties are willing to accept.

- Review Warranties and Representations: Any warranty or representation must be evaluated and weighed. Ensure they are credible and justifiable to avoid any issues being associated with wrong information and resources.

- Detail Payment Terms: Be specific with the magnitude and frequency of the payments and if there are initial payments known as deposits or progress payments.

- Consult Legal Counsel: Often, it is helpful to have an attorney look at the final document to promptly check whether or not the legalities of the agreement are suitable and whether or not your needs are being met in the deal.

- Include Governing Law: Determine the legal jurisdiction under which paragraph 7 of the agreement will be governed to eliminate legal ambiguities or disparity.

The fact is that a template represents only the general shape of a document – it must and should be adjusted to the concrete transaction. It is always recommended to address the legal adviser regarding the document’s validity.

Differences Between Asset Purchase Agreement and Stock Purchase Agreement

Where the business purchase is concerned, the transaction’s nature and cost structure influence the transaction’s misc aspects. Two standard acquisition techniques are used in APA and SPA Business Acquisition Agreements. The primary generator of a difference between the two is anchored by defining the actual commodities being bought and sold.

Asset Purchase Agreement (APA)

Under the AACSP, a buyer only buys particular business assets instead of the entire business enterprise. Such assets may include machinery, raw materials stocks, permits, and customer databases, among others.

It can also be true that the buyer may wish to assume some of the risks selectively. This kind of deal lets the buyer conduct business without having all the legal and financial baggage that the seller might be carrying, which is okay when there are many worries about possible risks.

Stock Purchase Agreement (SPA)

On the other hand, the Stock Purchase Agreement refers to acquiring a share of the company from the seller. The buyer receives the controlling stakes in the company and thereby becomes the legal owner of all the company’s stakes along with all the company’s properties and liabilities. This can be pretty direct, but it does mean that new or hidden liabilities may also be included with the purchase.