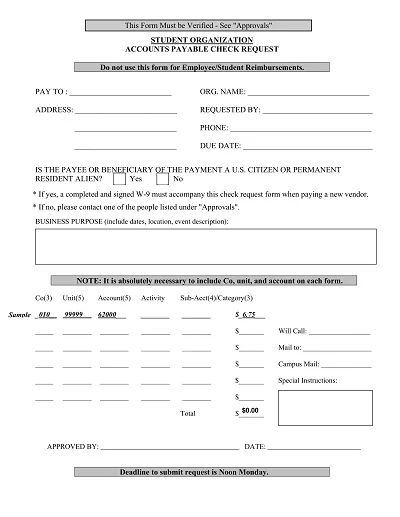

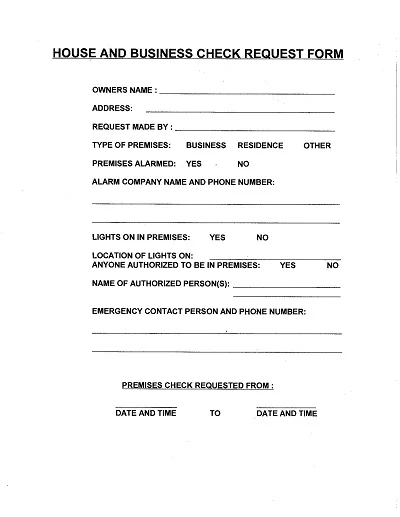

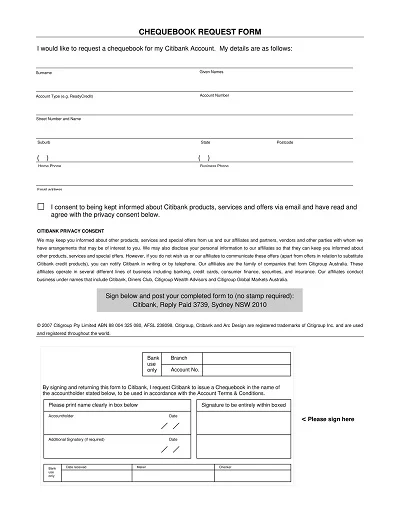

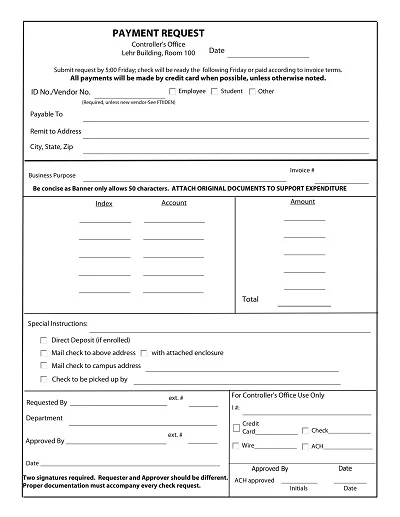

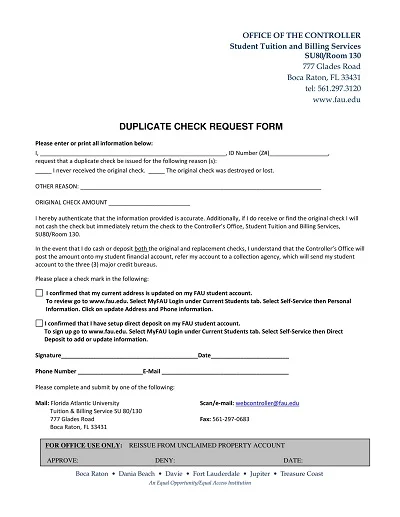

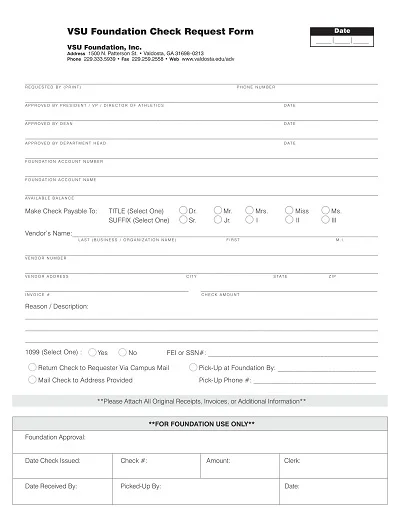

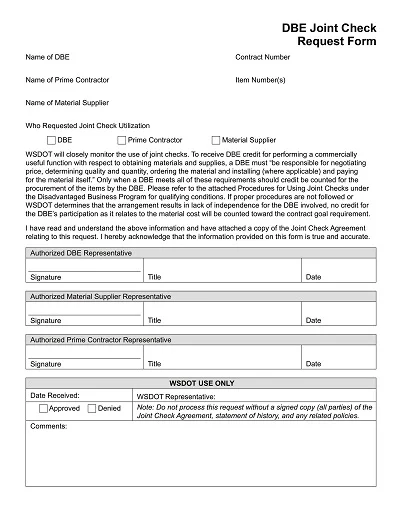

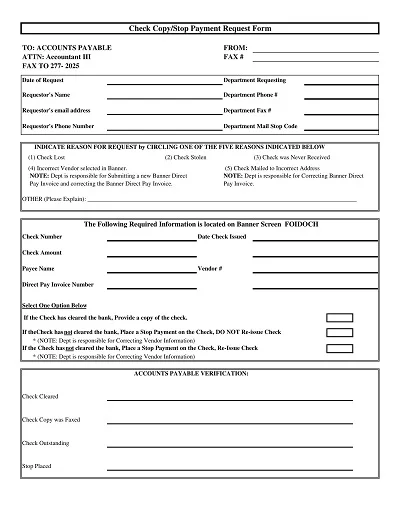

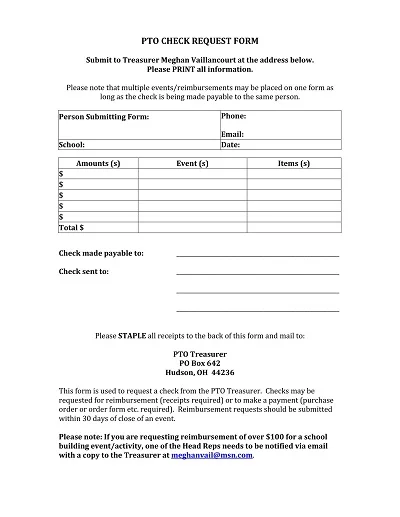

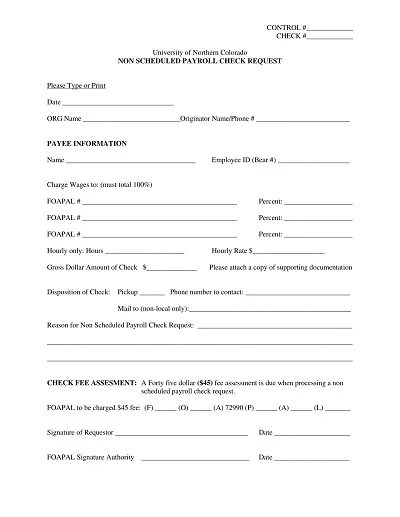

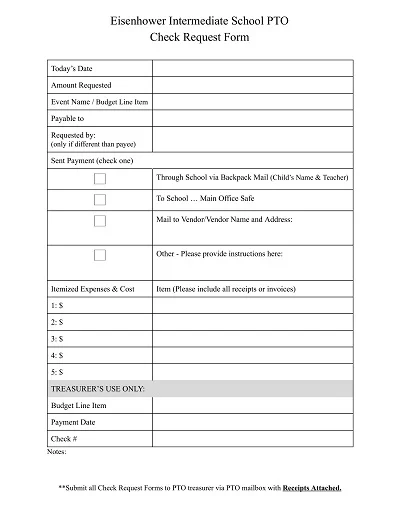

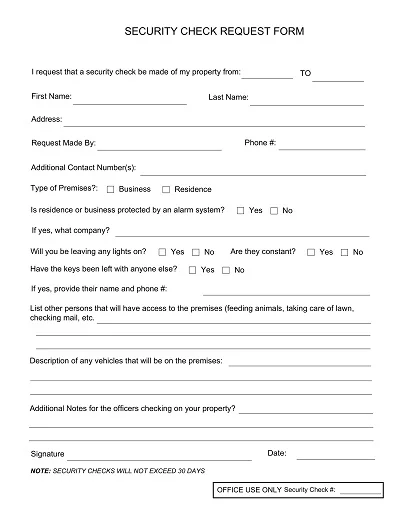

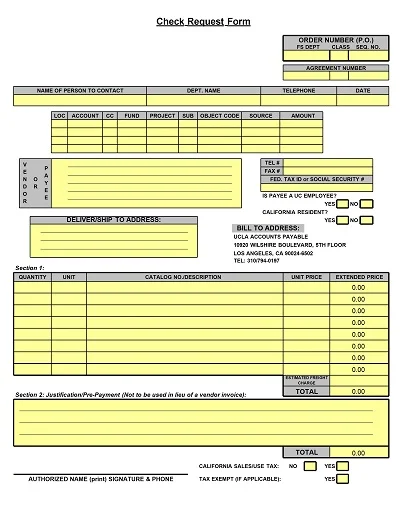

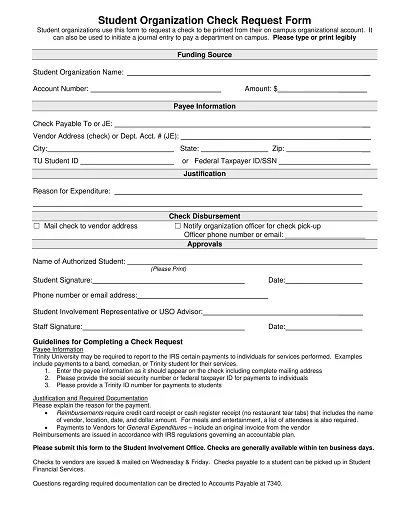

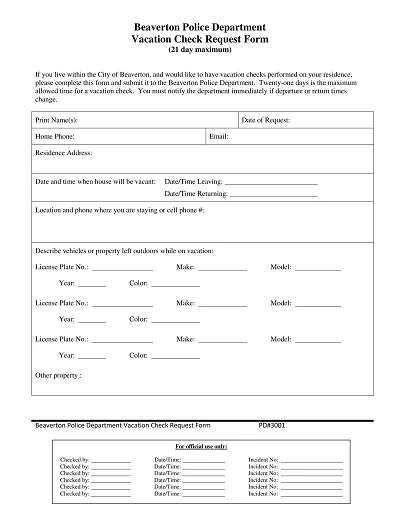

A Check Request Form Template is a template that organizations use to make a formal request to issue a check in payment. It generally has spaces for the payee’s name, the amount to be paid, the date, reference details, and the account to be debited.

It may also need the input or approval of authorized personnel to document and authorize expenses appropriately. This form simplifies payment procedures, guaranteeing the collection of all pertinent data and documentation for accounting and auditing requirements.

Download Free Simple Check Request Form Templates

What is a Check Request Form?

A Check Request Form is any form filled out and used by organizations or individuals to request payment via check when normal invoicing is not possible.

This form usually contains information concerning the payee, the reason for payment, the amount to be paid, and perhaps authorization. It helps simplify the method of payments and provides necessary documentation along with authorization.

Types of Check Request Form

Different check request forms can be used depending on an organization’s needs and requirements. Some common types include:

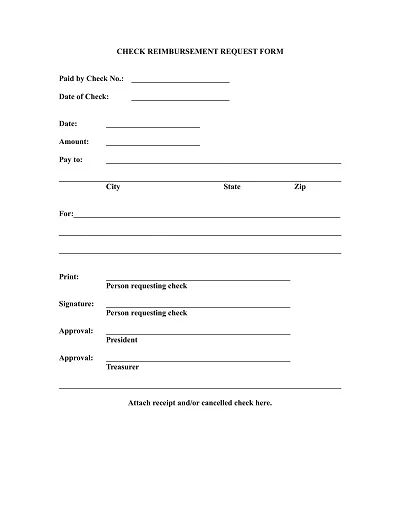

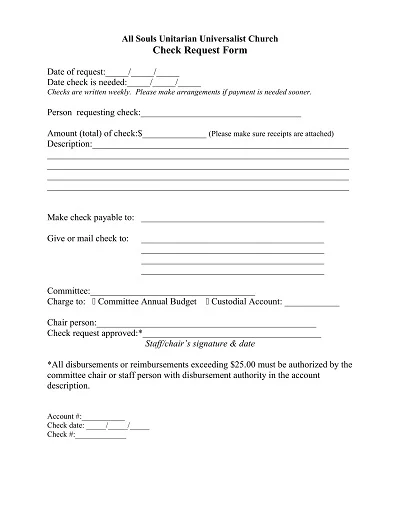

1. Reimbursement Check Request Form

Employees or members of an organization complete this form to help the organization compensate them for any money they have spent using their money for the organization’s activities. Usually, the receipts must be scanned or attached, and a clear description of the expenses must be provided.

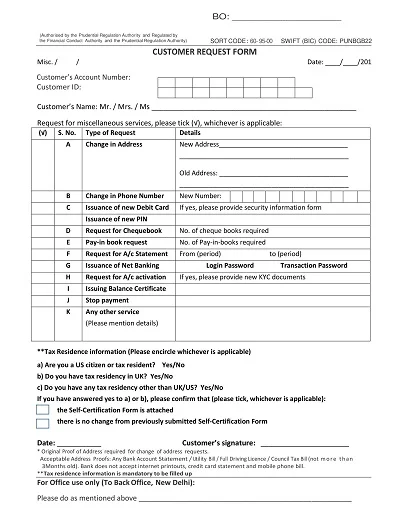

2. Vendor Payments Check Request Form

Employers use this form to process vendor payments for goods or services received. It contains information about the vendor, the invoice number, and the due amount.

3. Refund Check Request Form

This form is usually used when customers or members require a refund from the organization. This may include documentation supporting the refund request and the original payment details.

4. Petty Cash Check Request Form

This form typically requests funds from a specific petty cash account for daily minor expenditures. At times, it is done in consultation with a specific manager or supervisor to seek permission.

5. Donation Check Request Form

This form is used when one or more individuals/organizations give money to a particular organization. It captures information about the donor, the amount to be donated, and any conditions the donor may have for the donation disbursement.

6. Travel Expense Voucher Form

This form is of the ‘reimbursement’ type, as it asks for coverage of the cost incurred for business-related travel such as flight, hotel, meals, and transport. Usually, it has to be backed by attached receipts and a detailed bill division.

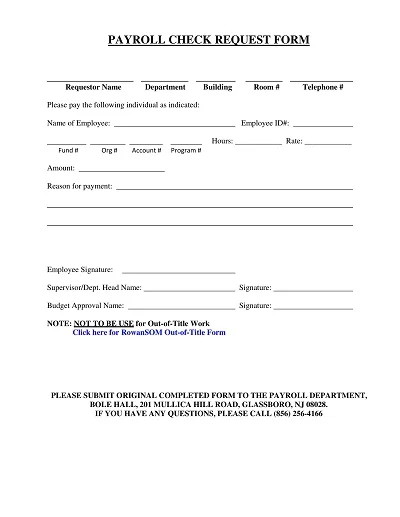

7. Payroll Check Request Form

Subordinate: It is common for employees to fill out this form to change their payroll information, such as bank account details for direct deposit or change in tax exemptions and details of a lost check.

8. Paycheck advances request form

An organization can use this type of write-up to seek early reimbursement for expenses incurred during organizational operations for which petty cash or any other cash equivalent has not been provided.

9. Check Request for Independent Contractor

It is applied when one party contracts with another contractor to provide specific services and requires reimbursement. It often contains information like the contractor’s name, address, and the kind of services that he or she offers.

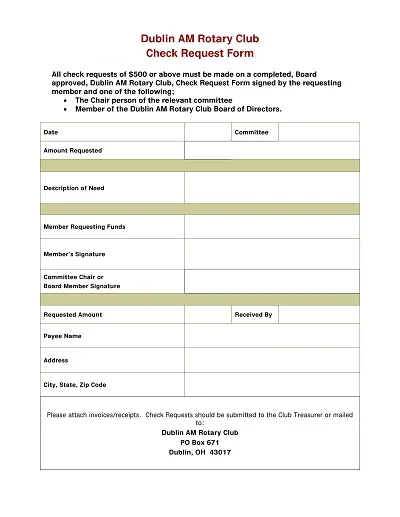

10. Special Order Check Request Form

Some organizations may utilize this form to make a check for a specific order or one-time expenditure, which is not payable by any other check request form. It could be event tickets, equipment hire, or specialized services.

What should be included in a Check Request Form?

Some of the essential details required when completing a Check Request Form include the following: Essential details to include are:

- Requestor’s Name: The complete name of the person or department that issued the request.

- Date of Request: The date on which the request is being made.

- Payee Information: The check payee is the name and address of the individual or any other legal entity to whom the check will be issued.

- Amount: The amount requested is entered in dollars and cents.

- Purpose of Payment: When payment is sought, a clear explanation of why the payment is required, complete with specifics to support the cost.

- Account Number: Depending on the case, the specific account number out of which the stipulated sum should be paid.

- Authorization: Additional endorsement from the approving authority, which includes the check requestor and the supervisor or officer of the organization for the check.

- Contact Information: The requestor’s phone number or email address should be provided for clarification or additional details.

- Attachment of Invoices or Receipts: If the request concerns reimbursement or payment for an invoice, it may be important to attach the original documents.

- Deadline for Processing: If the check is required by a particular date, this must be stated for compliance with the deadline.

Benefits of a Check Request Form

Using a Check Request Form in an organization facilitates financial exchange and has added advantages, including efficient control, fairness, and enhanced speed in the processing of checks.

This is an important function that helps to establish complete and accurate records of payments to be made and then authorizes the same to process payments compliant with the specified standards. This not only assists in achieving a clear audit trail but also reduces errors and time delays, which in turn helps to enhance overall accountability and financial report accuracy.

How to Utilize a Check Request Form

Utilizing a check request form efficiently involves several key steps:

- Gather Necessary Information: While completing the form, make sure you have all the necessary information, such as the name of the payee, the exact cash amount to be paid, and the nature of the check. This makes the workflow easy, and few changes are required.

- Fill Out the Form Completely: Ensure that every field in the form is filled appropriately. This includes the date the payment will be made, who should be paid, the amount to be paid, the account to be debited, and any further information regarding the payment.

- Attach Supporting Documentation: Invoices, contracts, or any other supporting documents relevant to the payment requested should always be included. This is especially important for documenting and tracking changes that have taken place, especially from the auditor’s perspective.

- Obtain Required Approvals: It should also be noted that if the form is going to be submitted to any other parties, they should also sign it. Approach signatures play critical roles in internal control and payment authorization.

- Submit the Form Promptly: Paying on time is important, particularly where the payment is based on a particular date in the calendar. When payments are paid after the agreed time, one would need additional charges or cause discomfort to vendors.

- Track the Request: If the form was submitted online, retain copies of the completed form and any other numbers. Check up occasionally to see if the payment has been processed. If not, ensure that there are no complications.

When to Use a Check Request Form

The Check Request Form is employed when there is no conventional purchase order process. This involves payments to suppliers who do not take purchase orders, settlements of bills where invoices are provided, and compensations for employees’ expenses incurred while on business trips, among other things. It is a formal request for payment processing that ensures accurate financial transaction recording and adherence to company policies.

How to Create a Check Request Form Template

Calling for a Check Request Form Template entails several steps to ensure the form is accurate and easy to process.

Here’s a guide to help you build your template:

Step 1: Define the Purpose

- Determine if the check request form is for reimbursement purposes or for any service to be delivered.

- Decide who will fill out the form (other employees, vendors, etc. )

Step 2: Select a Format

- Determine if the form is to be electronic or a hard copy.

- Choose a software or platform if you design a digital form (e.g., Microsoft Word, Google Forms).

Step 3: Include Essential Fields

- Requestor’s Information:

- Name

- Department/Unit

- Contact Information

- Payment Details:

- Payee Name

- Amount

- Date Needed

- Purpose/Description of the Payment

- Approvals:

- Immediate Supervisor

- Finance Department

Step 4: Design the Layout

- Arrange the fields so that data, dependent on each other, are placed together.

- The form should be easy to fill in. All questions should be clearly labeled, and the response boxes should be appropriately sized.

Step 5: Review and Test

- Please check the form you have filled out and whether it requires any additional information.

- Focus group: Introduce the form to a small group of potential users to gather feedback.

- Modify if necessary, depending on feedback received.

If done correctly, the Check Request Form Template can be easy to use and efficiently serve the organization’s purpose.