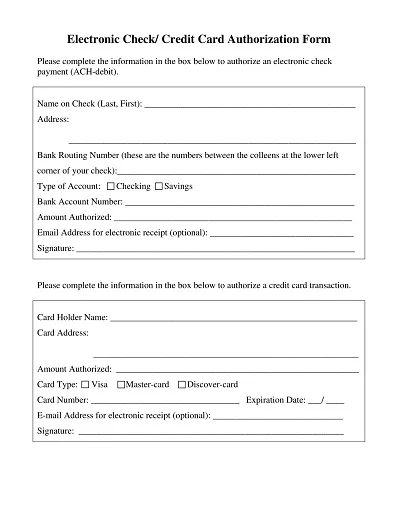

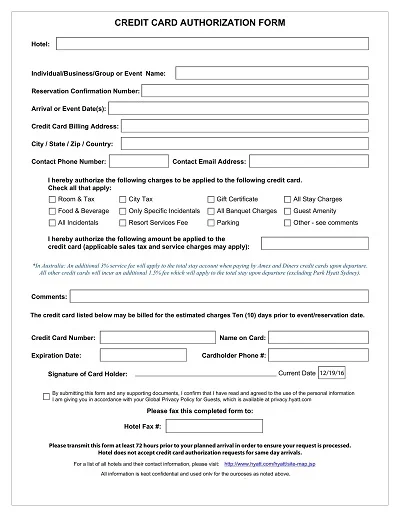

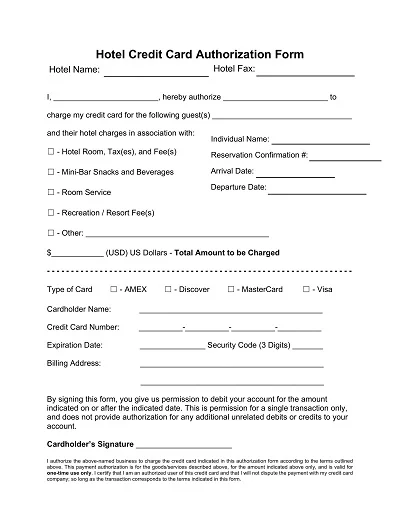

A Credit Card Authorization Form Template is a legal way merchants or businesses obtain cardholders’ consent to allow charges made to his or her credit cards for a certain amount. A credit card template typically entails the cardholder’s name, card number, expiration date, CVV number, the value of the spending transaction, and a section left open for the cardholder to sign to authorize charges.

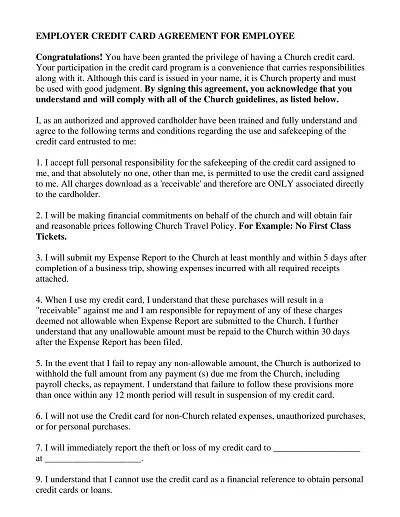

This form is the best protection against fraudulent charges and chargebacks, as it allows the merchant to ensure that the cardholder gives him/her consent to effect the payment transaction.

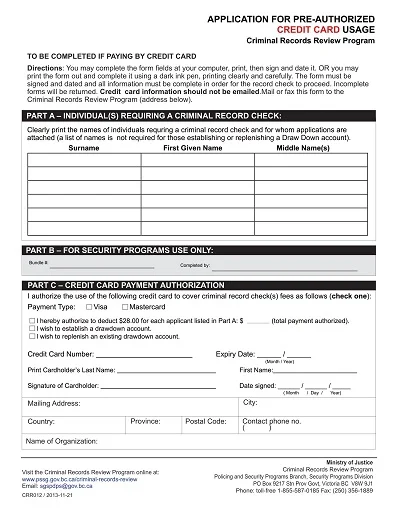

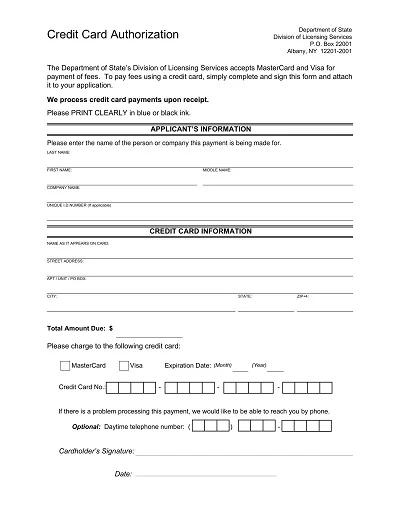

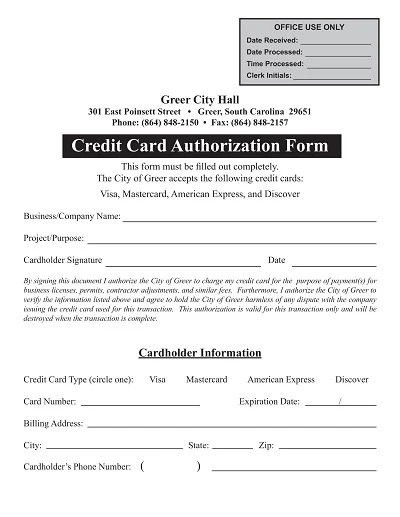

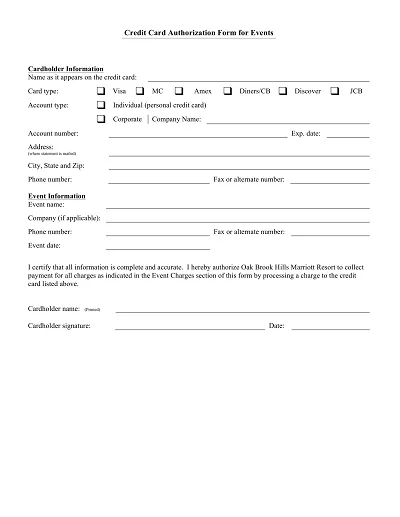

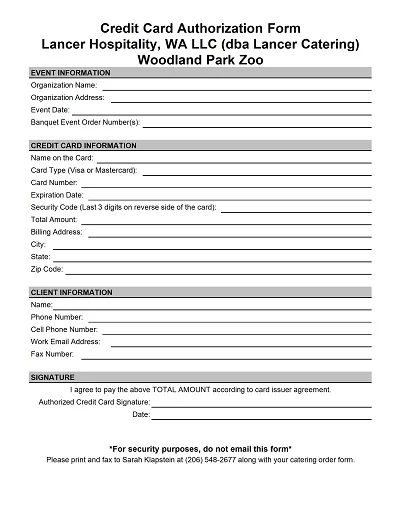

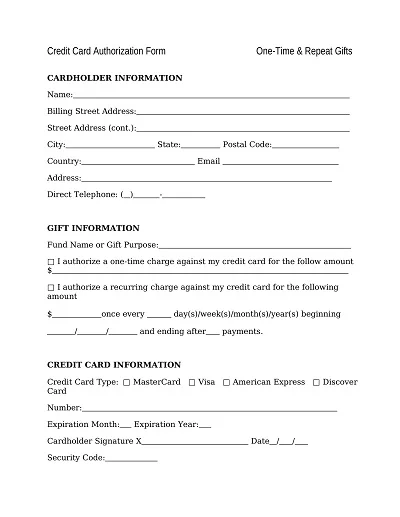

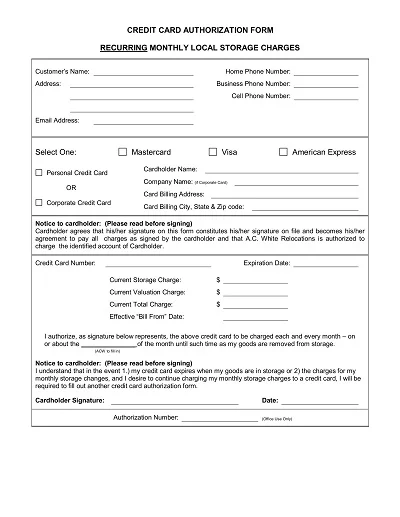

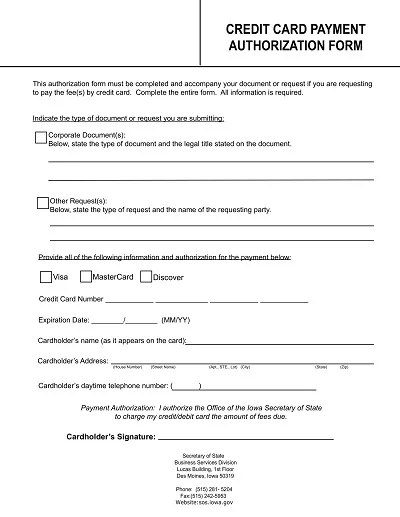

Download Free Credit Card Authorization Form Templates

What is a Credit Card Authorization Form?

A Credit Card Authorization Form is a document through which a customer allows a vendor or a particular business to charge his or her credit card for a particular amount in connection with goods or services. It confirms the consent for the specific amount charged and agreed forms of payment; hence common where actual charges occur online or through the phone.

This form often encompasses important information like the credit card number, expiration date, billing address, and the cardholder’s signature to ensure that the report autonomously approves the transaction and addresses identity theft problems for the business or company and the cardholder.

What are the Benefits of Credit Card Authorization Forms?

Credit card authorization forms are a critical component of secure payment processing, offering numerous benefits for both businesses and customers:

- Enhanced Security: They create an additional protection layer for a card transaction to ensure the cardholder has authorized the transaction and blocked fraudulent operations.

- Improved Cash Flow: Such forms can significantly help optimize the payment process and prevent various time-consuming and ineffective procedures, thus helping to enhance the business’ cash flow.

- Legal Protection: In the case of a contest, the authorization of a credit card form is legal, hence protecting the business as it demonstrates that the cardholder allowed the transaction.

- Customer Trust: Their employment shows that a business organization observes customer data and transaction record details to enhance patron loyalty.

- Record Keeping: It plays the vital role of providing records that assist business entities and consumers in accounting and other forms of financial dealings.

Why use a Credit Card Authorization Form?

At this juncture, it is important for organizations that usually transact business with customers electronically to complete the Credit Card Authorization Form.

This form is used because it will prove that the cardholder has accepted that the merchant can charge on his/her card for the services or products it has provided; thus, it will protect the merchant in cases where chargeback or fraudulent disputes occur.

It ensures the merchant does not violate provisions of payment processing policies and protects the merchant’s right to collect the payment, ensuring both the business and consumer are safe.

How to Implement a Credit Card Authorization Form

Adopting a credit card authorization form is a very important process that business organizations are willing to perform to ensure the efficient and secure processing of transactions. Below are the detailed steps with subsections to guide you through the process:

1. Select a Secure Platform

Ensure the operational platform or software is configured to meet the Payment Card Industry Data Security Standard (PCI DSS) to ensure the credit card information provided is secure.

2. Design the Authorization Form

Ideally, you should formulate input fields that include the basic ones like the cardholder’s name, credit card number, expiration date, CVV code, and transaction amount. You should add one more line where the cardholder can put their signature.

3. Clarify Payment Terms

Prescribe the specific payment options you want to implement, such as the intervals, the nature of the charges, and the due date. It helps establish trust from your customers since one can see through what someone else has created.

4. Obtain Written Consent

Ensure the form contains a section where the cardholder provides permission to make the transaction(s) and agree to the payment terms. This authorization may not be completed for the cardholder; it must be signed with consent.

5. Process the Form Securely

After completing the form and obtaining the client’s signature, submit it through your secure online environment. Remember that as much as the filled form contains your customer’s information, you should follow PCI DSS when storing or disposing of the form.

6. Provide Confirmation

This should then be followed by giving the customer a transaction receipt indicating the transaction amount, the date the transaction was made, and its purpose. This also works as a receipt, which is important to the customer and your business.

It is recommended that companies and merchants that accept credit cards adhere to the above steps to eliminate the middleman and guarantee both the protection of their customers and the efficiency of the transactions.

Types of Credit Card Authorization Templates

There are several types of credit card authorization templates, which, in turn, are utilized for a particular intent in a given transaction. These include:

- Recurring Payment Authorization Form: This template is utilized when a merchant intends to make a payment from a customer’s credit card due to continually, for example, subscriptions or membership. It is only possible by gaining the customer’s consent to use their credit card to make regular payments.

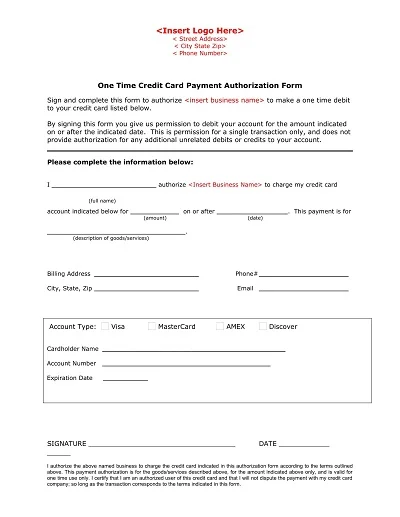

- One-Time Payment Authorization Form: This form is helpful in a single transaction where the merchant requires permission to charge the credit card for a solitary request. This is commonly applied when purchasing online, booking, or accessing a certain service.

- Refund Authorization Form: In instances that a refund has to be made and should be charged back to the particular credit card, the said template is employed to acquire the cardholder’s consent regarding the refund amount to be charged to the card.

- Phone Payment Authorization Form: This template is helpful for scenarios such as the buyer and the seller sharing credit card details over the phone. The ability that it serves to record the consent made by the cardholder to the particular charge in question is also valuable.

Each template is designed for a specific transaction type, and they aim to make the transactions as secure and compliant with the requirements as possible.

How to Create a Credit Card Authorization Form Template

Designing a Credit Card Authorization Form Template comprises a few sub-processes to make it more effective and secure. Below are the details with subsections to guide you through the process:

1. Header Section

Start with a title describing its function for the form, for example, “Credit Card Authorization Form”; it is best if this would be in a bigger font type.

2. Cardholder Information

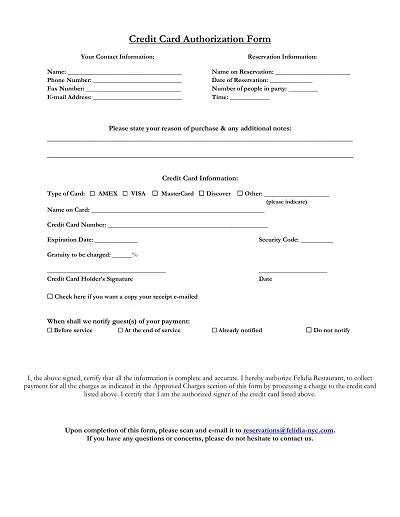

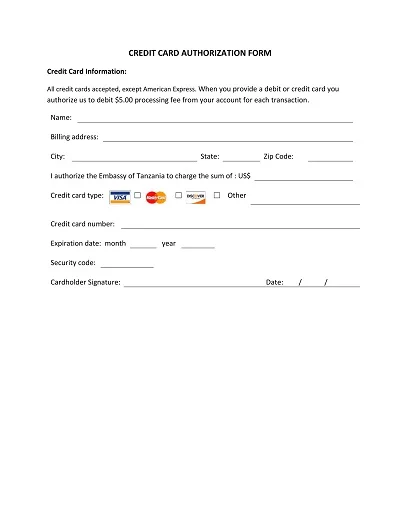

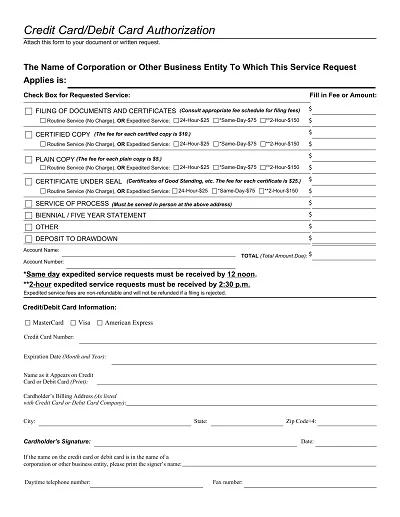

- Full Name: It is also appropriate to direct the cardholder to type their correct full name as they have it on the credit card.

- Billing Address: Ask the cardholder for the physical address they use for billing purposes, i.e., street, city, state, and zip code, to authenticate the card.

- Contact Information: This way, there will be space for phone numbers and e-mail addresses so cardholders can get through.

3. Credit Card Details

- Card Type: Add checkboxes or select a menu for the cardholder to choose his type of card (Visa, Master, American Express, and others)

- Card Number: A text field to enter the credit card number. Ensure proper measures are taken to secure any content of this information.

- Expiration Date: The expected input should involve two specific fields that explain the month and year of expiration of the debit or credit card.

- CVV Code: A tiny rectangle for the entry of CCD, usually placed at the back of the card as a security feature.

4. Authorization Statement

Prepare a short phrase stipulating the cardholder’s consent and acceptance of the stated conditions. Equip the documents with a field where the date of authorization is provided.

5. Signature

Add a line for the cardholder’s signature – this will always be necessary and serve to confirm the form. Look into options that allow for the use of a digital signature if the form will be completed electronically.

6. Instructions for Submission

Finally, emphasize the expiration date and provide specific information on how and to whom the completed form should be sent – preferably through email or fax. If anything needs to be done in the security aspect to ensure the mail is safely conveyed, the process should be stated in detail, such as encrypting the email.

7. Privacy Statement

Inform the cardholder that every piece of identifying and sensitive information they provide is well protected. In the brief, explain how you will utilize the data collected and how data privacy and security will be achieved.

From the following detailed guidelines, you can achieve appropriate formulation of the Credit Card Authorization Form Template that is not only comprehensive but also secure, ensuring simple and secure transactions in business, therefore increasing trust with the various entities involved.