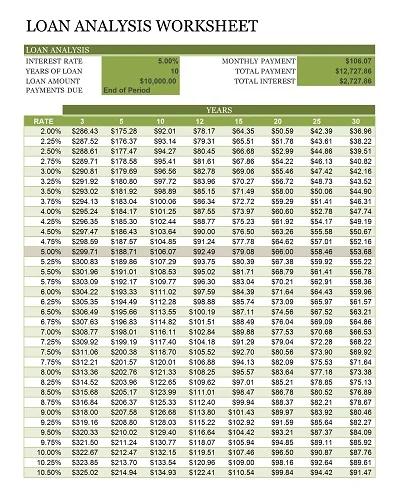

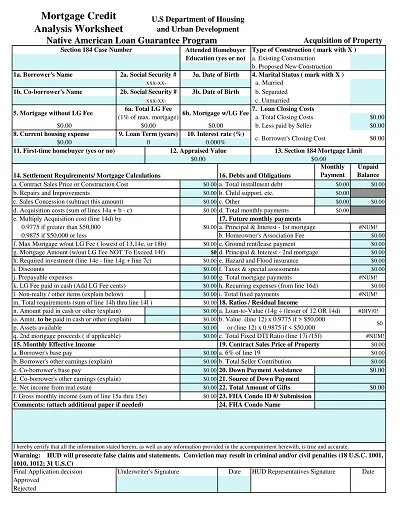

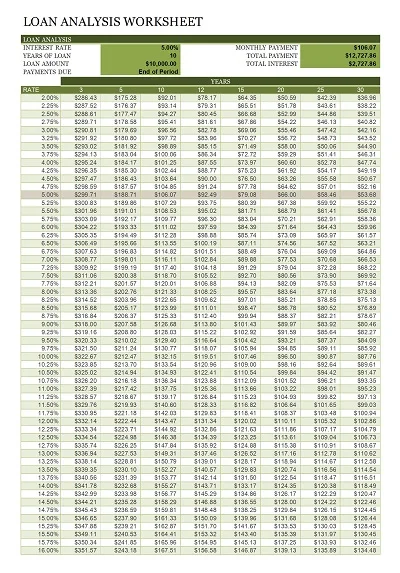

Loan Analysis Worksheet is a detailed strategic plan for ordering and deciding on financial offers aimed at borrowers and lenders. They enable the borrower to logistically understand the loan terms, such as the interest rate, the period in which the loan is exercised, monthly repayments, and the overall cost of the exercise at the end of the period within which the exercise is made.

Also, it may categorize one loan against another to make borrowers choose the best loan based on technical and non-technical factors that define the applicant’s creditworthiness.

Download Free Loan Analysis Worksheets

What is a Loan Analysis?

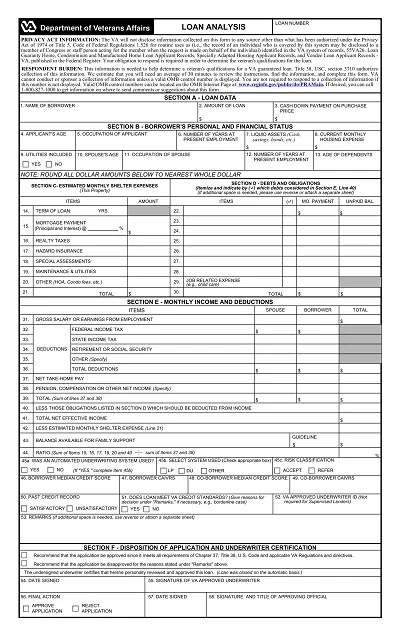

A Loan Analysis therefore refers to an important evaluation process undertaken by the loan providers in evaluating the potential borrower’s credit worthiness and ability to repay the loan amount as required.

This full-sought analysis includes generally checking the borrower’s solvency, credit rating, minimum income, ratio of credit utilisation, and other economic factors. The main goal of this step is to decrease the level of risk as much as possible by having confidence that the borrower will be able to meet the loan obligations; this makes it a very significant step in the whole process of extending credit.

Types of Loans

As there are various forms of credit, there are multiple types of loans to suit several purposes and situations. Here’s a brief overview:

- Secured Loans: Common examples of these loans are secured, meaning that the goods like a house or car offered are taken by the lenders in case of repayment default. They commonly advertise lower interest than other loans since they are less risky.

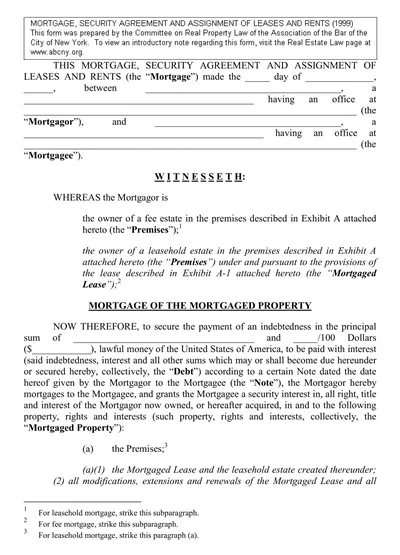

- Mortgages: These are applied in the acquisition of real estate where the parcel of the property constitutes the security.

- Auto Loans: The loan is used for buying cars through its security being on the hired vehicle.

- Unsecured Loans: These do not have securities necessary to give but rather attract a higher interest rate because of the higher risk involved on the side of the financier.

- Personal Loans: These can be for any reason, with the most common use being managing debt through debt consolidation or funding a large expense.

- Credit Cards: Tender credit for the clients’ shopping due on certain specified products, whereby interest charges are made for the amount the customer does not pay in full at the end of the month.

- Student Loans: These loans are meant to help students pay for their educational costs, and they can either be federally designed by the government or private and are set by private lenders.

- Business Loans: Designed to finance a company’s needs, from initial investments to development activities, and can be collateralized or non-required.

For each type of loan, there are some specifications and terms of receiving the credit, which can be chosen according to the potential borrower’s needs and financial state.

Factors to Consider in Loan Analysis

There are also several essential conditions that must be considered while considering a loan’s feasibility. These include the borrower’s credit record, an important factor identifying their ability to service the loan. The second ratio is the debt to income which can also help to understand the solvency of the borrower since it shows the total monthly payments for all the debts compared to the income.

Furthermore, the interest rate of the loan and the time that has been taken to arrive at this rate influence the cost of the loan to the borrower and the repayment cycle. Moreover, the goal of the loan and securities given also play an important role in determining the level of risk for extending the loan and its rate.

Benefits of Conducting a Loan Analysis

The following are the benefits that can accrued from engaging in a loan analysis when making any form of borrowing deals.

Here are the key advantages:

Understanding Total Costs

A proper loan analysis assists in understanding the overall cost of the loan in the process, including the interest rate, fees and any other incidental charges. It makes understanding the amount borrowed easier, and this can help borrowers better in their decision-making process.

Comparing Options

It helps one to make comparisons of different loan products, rates and other favourable conditions from different money lenders, thus making the final choice easier.

Identifying Affordability

This way, you verify whether income-to-debt ratios are possible in the long run on the basis of the loan; this significantly helps to prevent additional economic stress.

Negotiation Leverage

By understanding the specifics of a certain type of loan and comparing the terms offered, the borrowers can bargain with the loan providers effectively.

Long-term Financial Planning

Awareness of the consequences of borrowing enables users to be knowledgeable when it comes to servicing their debts, which is relevant in achieving an individual’s financial objectives.

How to Create a Loan Analysis Worksheet

It is important to clarify that loan analysis should be carried out through several crucial steps in order to develop the worksheet.

Here’s how to go about it:

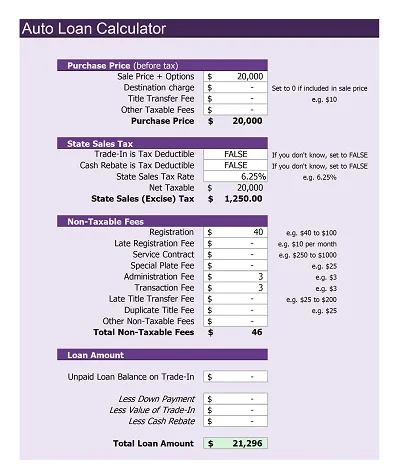

- Determine the Loan Amount: The first step in evaluating the amount of collateral to place with the lender is to identify the total loan amount you are targeting. This will form a basis for further computation In a more algebraic approach, this computation may be represented as, CahsDeposit×RatePeriod=TotalInterestEarned

- Interest Rate Assessment: Record the interest aspect of the loan. If so, qualify the terms and conditions of varying interest rates to prepare for the turn of events.

- Loan Term: More so, note that the part of the loan is taken in either years or months. This impacts the interest rate charged within the total time taken to complete the repayment of the loan amount.

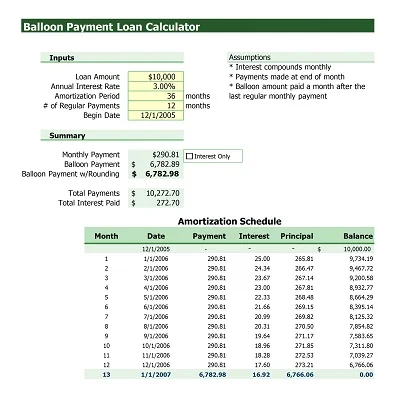

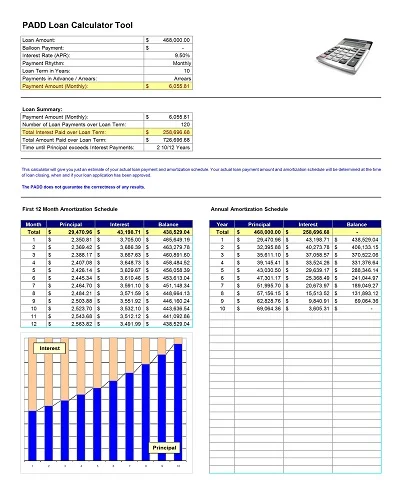

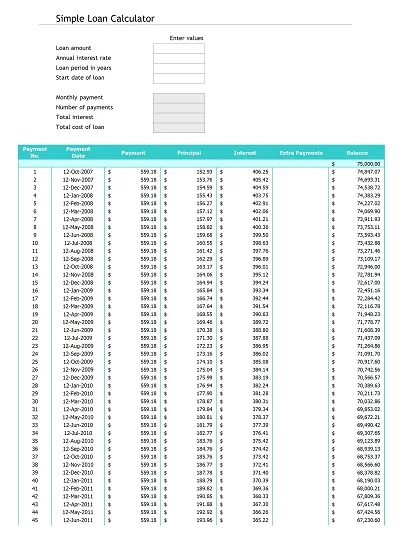

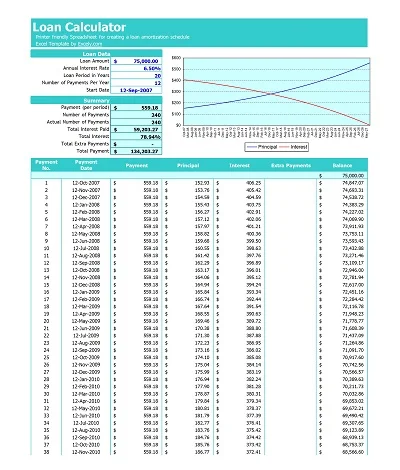

- Monthly Payment Calculation: To be specific, given the loan amount, interest rate, and term, determine the monthly payment. A simple internet user with good knowledge of MS Excel can perform calculations using the PMT function.

- Total Cost of the Loan: This means the amount that is payable in monthly instalments is the product of the monthly payment, and the total number of payments shall be the total amount of the loan, including interest.

- Prepayment Penalties: Should the credit company allow for early repayment of a loan, inquire about the penalties in case of prepayment. This might have the knock-on effect of altering one’s decision to redeem the loan before a specific period is over.

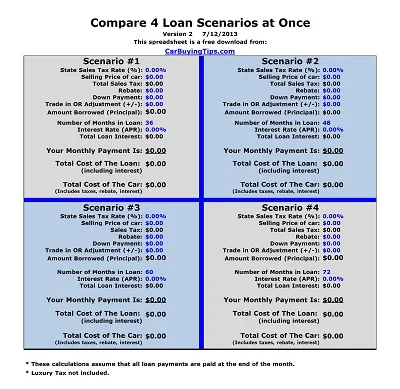

- Comparative Analysis: Just do the same for each if you are considering several loan offers to weigh the chances and12 compare the costs, monthly payments, and terms.

In essence, this worksheet will be the all-inclusive document through which various loan choices can be made; therefore, effective borrowing decisions will need to be made.

How to Use the Loan Analysis Worksheet

Here’s a step-by-step guide on how to use the Loan Analysis Worksheet:

Understanding the Basics

Remember that the worksheet is composed of critical areas or questions that you need to answer. This involves comprehending lingo that pertains to the principal, the interest rate, amortization potential, and monthly payments. One needs to define these terms so that the reader can gain an understanding of them, as these form the basis of the analysis of loans.

Entering Your Loan Information

In the sheet, specific columns are provided to enter details of your loan, as discussed below. Some of these are the total amount of the loan, also known as the principal sum, interest rate, and the time of the loan, more commonly referred to as the amortization period. Please review these numbers to ensure that the analysis only describes the right data.

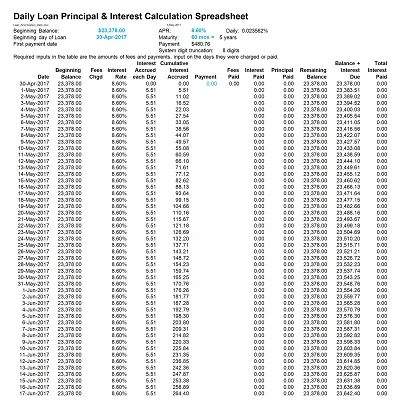

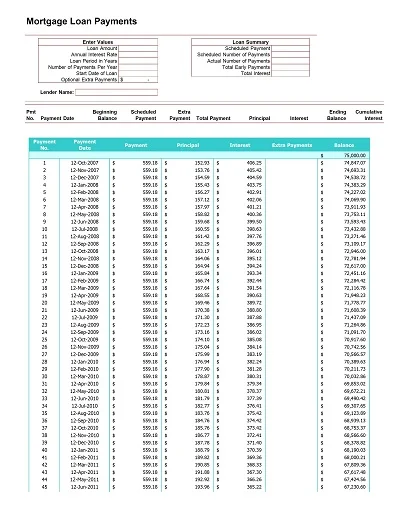

Analyzing the Payment Schedule

Once the first set of entries is made, depending on the circumstances, the worksheet will determine other aspects of the payment, such as the amount per monthly payment, total interest accrued throughout the entire period of the loan agreements, and the final sum due at the end of the term of the loan. You should look at these numbers very closely to recognize their overall importance to the loan’s terms.

Evaluating Additional Payments

Extra interest payment analysis is another essential part of many of the loan analysis worksheets since it highlights the effect of making payments towards the principal. Play with this feature entering some other, maybe hypothetical, monthly or yearly fees and find out how such changes lead to shorter loan duration and less total interest paid.

Comparing Loan Options

If you are comparing several loan offers, filling out the worksheet for each loan separately is advisable. This comparison will allow you to look at which option of a loan is the most economical run-through by comparing the total amount of interest charged and the length of the loan.

Making an Informed Decision

With this work done, you would probably find it easier to come to terms with the decision that relates to your loan. Compare it to affordability in terms of monthly payments, the loan balance and term, and what extra payments mean financially.