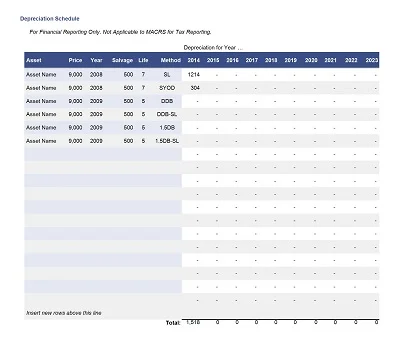

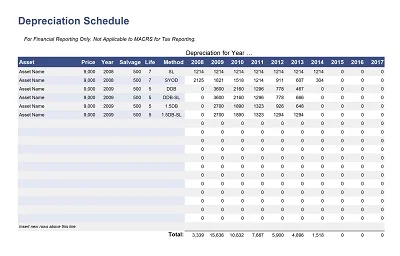

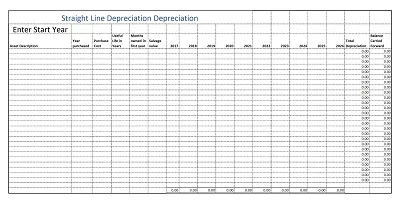

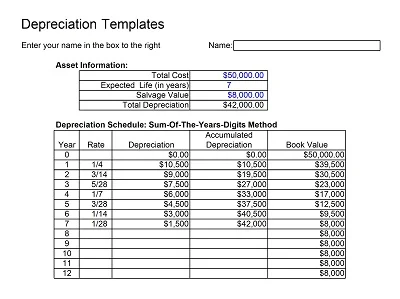

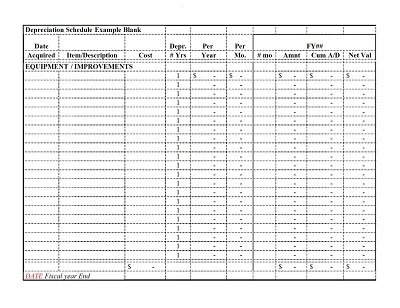

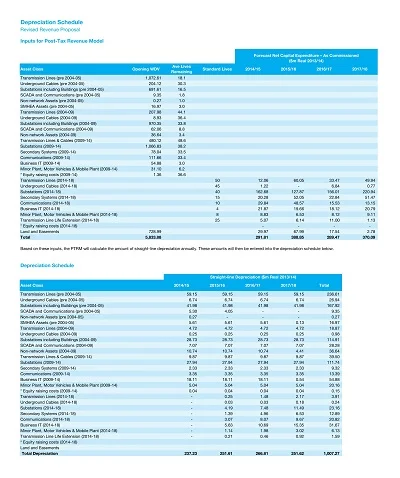

A Depreciation Schedule Template is a preformatted tool that aids in recording and forecasting the value reduction of assets over time. It provides a structured format for inputting relevant information, such as the asset’s cost, salvage value, useful life, and selected depreciation method. This template simplifies the complex calculations involved in the depreciation process and offers a visual representation of an asset’s depreciation trajectory.

The template is essential for accurate financial reporting and helps ensure adherence to accounting standards while facilitating strategic financial and tax planning. It acts as a historical ledger for asset values, enabling more informed decisions regarding asset management and investments. As part of a company’s financial documents, it is regularly referenced for budgeting, tax filing, and auditing purposes.

Download Free Simple Depreciation Schedule Templates

Benefits of Using a Depreciation Schedule

Employing a depreciation schedule offers an array of benefits that significantly contribute to your business’s health and success. Let’s unpack these benefits and how they can positively impact your business operations and financial standing.

Financial Planning

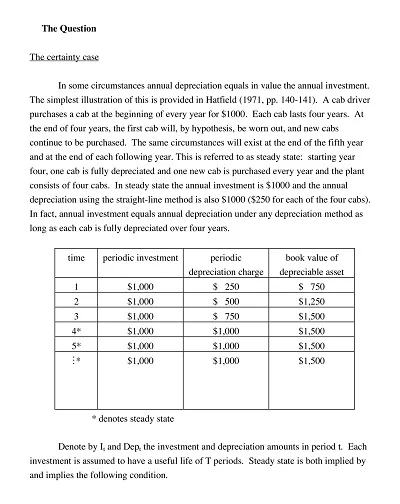

Consistent and precise asset depreciation calculations provide a clear understanding of the actual cost of your assets over time. This knowledge empowers you to manage cash flow, forecast expenses, and strategically time asset replacements or upgrades.

Tax Implications

A well-constructed depreciation schedule is a critical tool for optimizing tax deductions and reporting. It ensures that you’re not only maximizing your tax benefits but also accurately reflecting depreciation expenses on your financial statements, which adhere to tax compliance standards.

Asset Management

By recording and tracking depreciation, you’re effectively managing each asset’s lifecycle and overall business capital. This proactive approach allows you to identify underperforming assets, make informed sale or replacement decisions, and align your investment strategy with your business’s growth trajectory.

Types of Depreciation Schedule

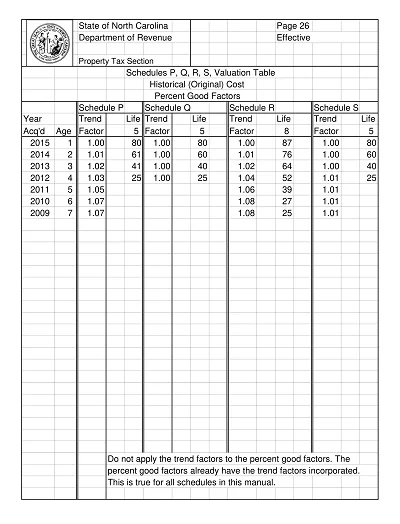

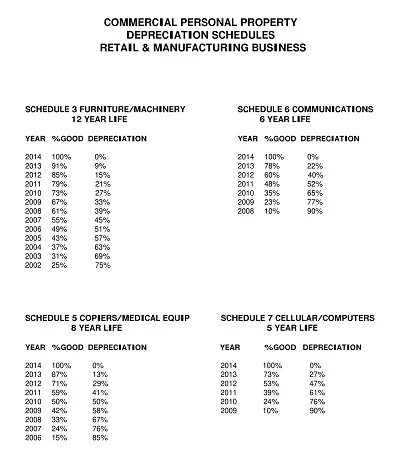

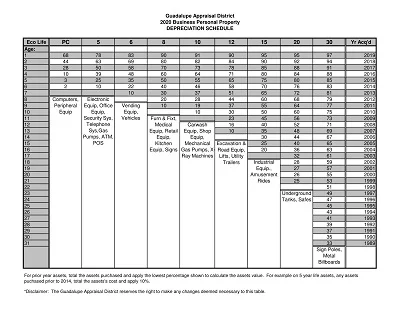

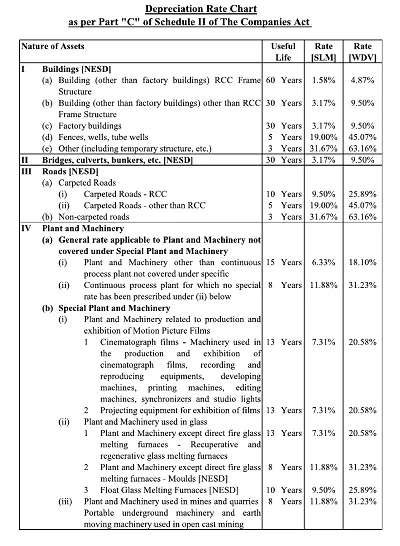

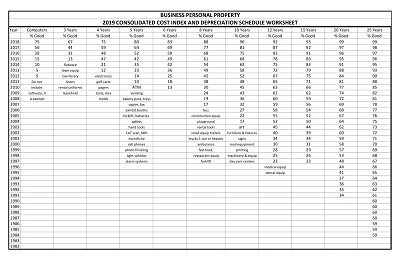

Depreciation schedules can vary depending on industry, asset types, and company practices. However, below are the widely recognized types of depreciation schedules:

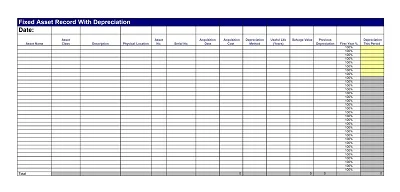

1. Full Depreciation Schedule

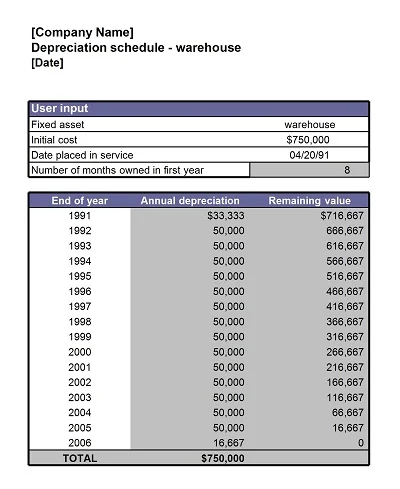

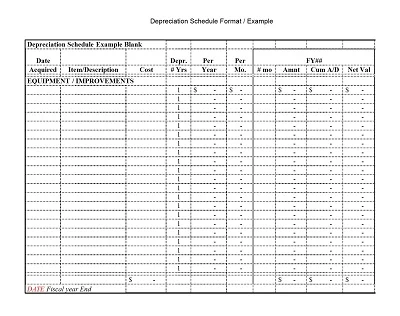

A full depreciation schedule includes all depreciating assets owned by a company. It lists each asset, its cost, accumulated depreciation, and book value. It’s updated regularly to reflect current values and is detailed enough for a complete financial analysis.

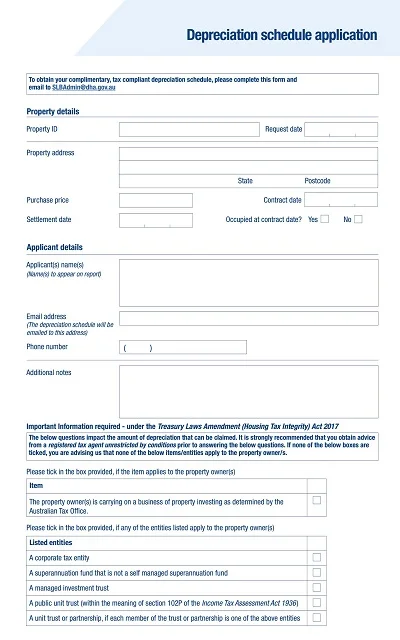

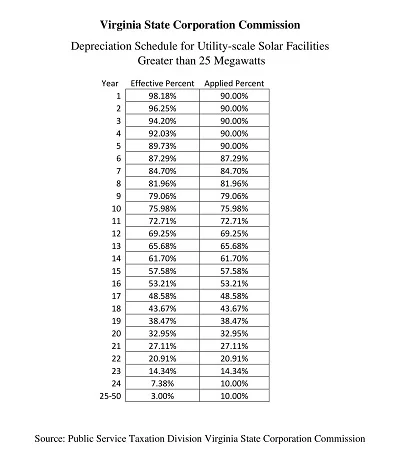

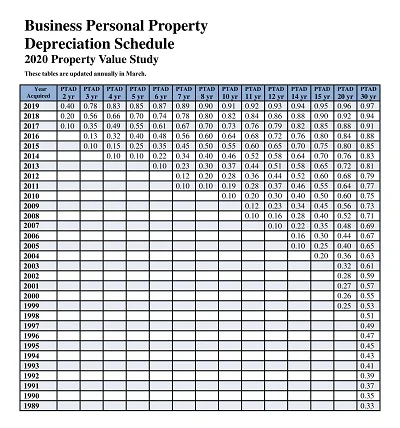

2. Tax Depreciation Schedule

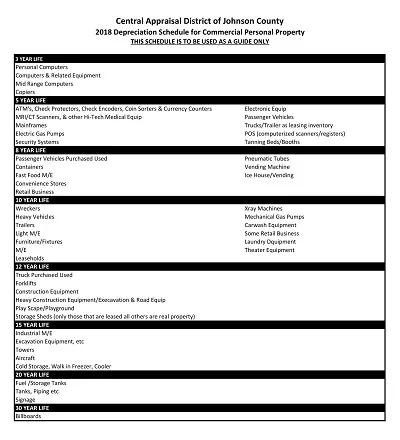

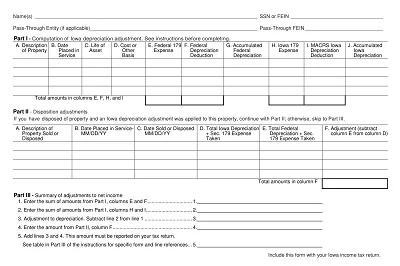

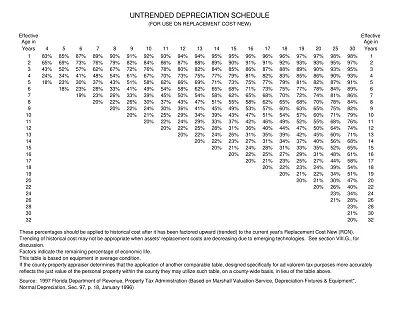

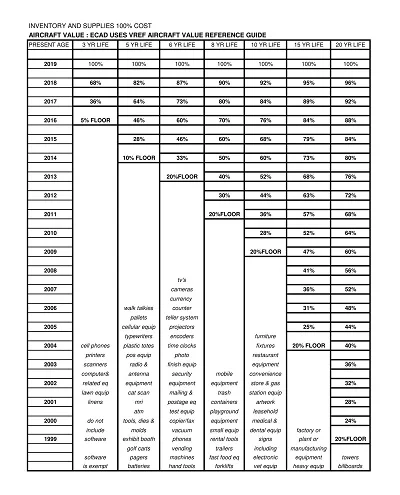

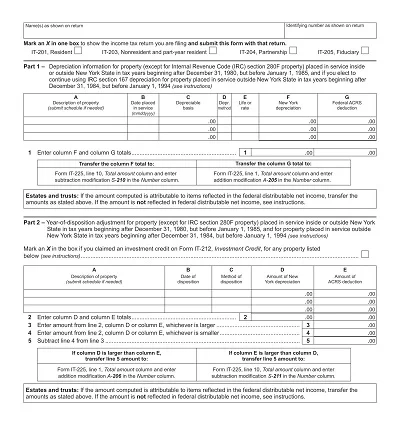

This schedule is specifically prepared for tax reporting purposes. It aligns with the tax regulations and includes only the information required for tax filings, such as the cost basis for tax purposes, accumulated depreciation according to tax rules and the current year’s depreciation expense.

3. Component Depreciation Schedule

In some cases, large assets, which comprise multiple significant parts, may have each component depreciated separately. This component depreciation schedule recognizes the various life expectancies and depreciation methods for each part of an asset.

4. Group Depreciation Schedule

Group or composite depreciation schedules are used when a company has numerous assets with similar life expectancies and depreciation methods. The investments are pooled, and depreciation is calculated on the group as a whole rather than as individual items.

5. International Depreciation Schedule

Companies operating across different countries may use an international depreciation schedule to ensure compliance with varying accounting and tax jurisdictions. This type of schedule accounts for the international standards and local regulations of asset depreciation.

Each of these schedules serves a specific purpose and is critical for different aspects of financial and tax planning. The choice of schedule depends on the business needs and the complexity and diversity of its assets.

Importance of Depreciation Schedule

Depreciation schedules are crucial for several reasons. They serve as a financial compass, guiding business owners in making informed decisions about asset purchases, maintenance, and disposal. By systematically accounting for the loss in value of assets over their useful life, companies can plan for the future with greater certainty and allocate resources more efficiently.

Additionally, depreciation schedules support businesses in tax planning, allowing them to claim appropriate deductions and reduce their taxable income. These schedules also uphold transparency in financial reporting, which can bolster investor confidence and satisfy regulatory requirements. In essence, maintaining an up-to-date and accurate depreciation schedule is fundamental for effective asset management and the long-term financial health of an organization.

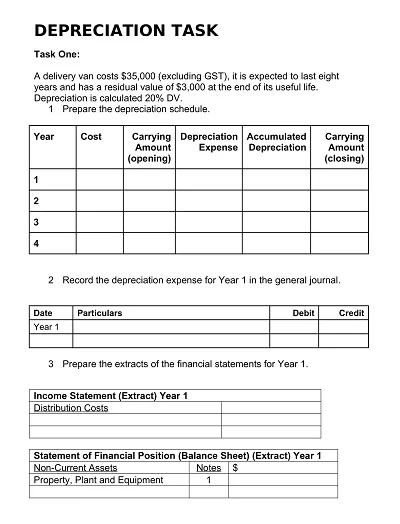

How to use a Depreciation Schedule Template

A depreciation schedule template is a useful tool for businesses to calculate the decrease in the value of assets over time. Here’s how to effectively use one:

Choose the Right Template

Begin by selecting a template that suits your needs and is compliant with the relevant accounting standards such as GAAP or IFRS.

Input Asset Details

Enter the complete details of the assets, including purchase date, cost, and salvage value.

Select the Depreciation Method

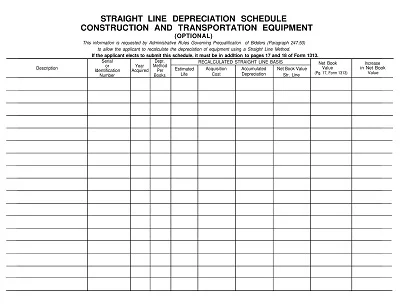

Choose a depreciation method (e.g., straight-line, double-declining balance, or units of production) based on your company’s accounting policies.

Fill in the Schedule

Populate the schedule by applying the chosen depreciation method to calculate and fill in the amount of depreciation for each period.

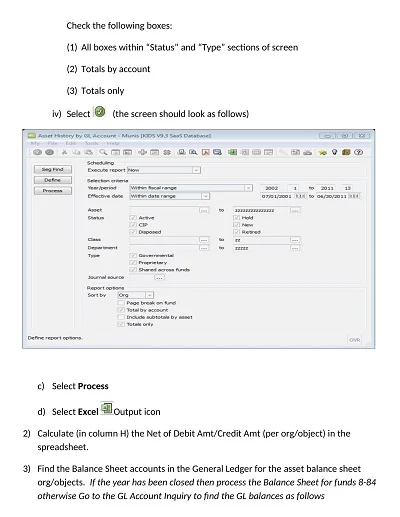

Review and Update Regularly

Ensure accuracy by reviewing the calculations. Update the schedule as needed to reflect any changes in asset use, value, or lifespan.

By following these steps, you can maintain an accurate depiction of your company’s assets and their depreciation over time.

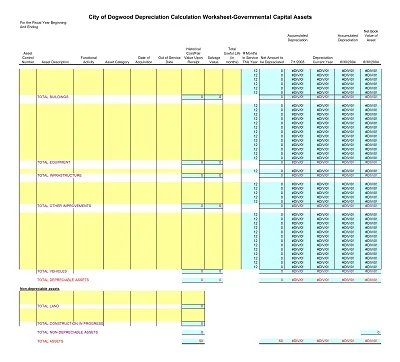

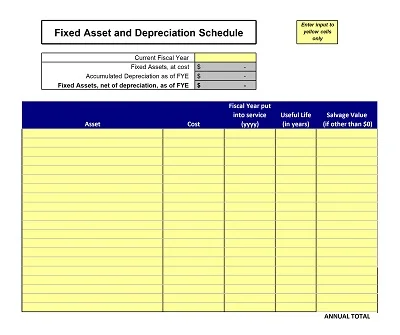

How to Create a Depreciation Schedule Template

Creating a depreciation schedule template involves a systematic approach that allows for the allocation of the cost of an asset over its useful life. To construct this template:

- Select the Method of Depreciation: Choose a method such as straight-line, declining balance, or sum-of-the-years’-digits, depending on your business needs.

- Determine Asset Information: Gather all relevant information about the asset, including cost, salvage value, and valuable life.

- Structure the Template: Organize your Excel spreadsheet to include columns for Date, Asset Name, Cost, Accumulated Depreciation, Annual Depreciation Expense, and Net Book Value.

- Insert Formulas: In Excel, enter formulas that automatically calculate the depreciation per period, accumulated depreciation, and net book value.

- Test Your Template: Enter sample asset data to ensure that the calculations are performing correctly.

This basic structure not only allows for consistent record-keeping but can also be tailored to fit various depreciation methods and reporting requirements.

Conclusion

In conclusion, a well-constructed depreciation schedule template is a valuable tool for businesses and asset managers. It ensures accurate tracking of an asset’s value over time, assisting in informed financial planning and compliance with tax regulations.

By utilizing a template, the complexities of calculating depreciation can be simplified, ensuring that all relevant factors are considered and errors are minimized, leading to a clearer financial picture and more strategic decision-making.