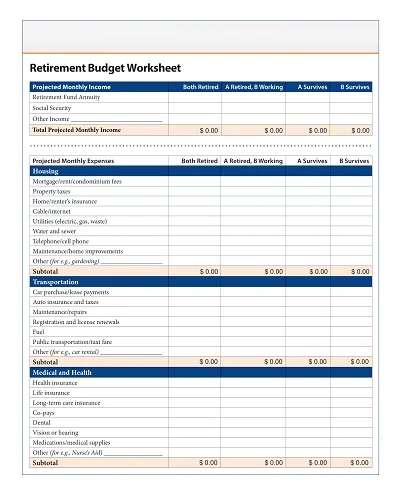

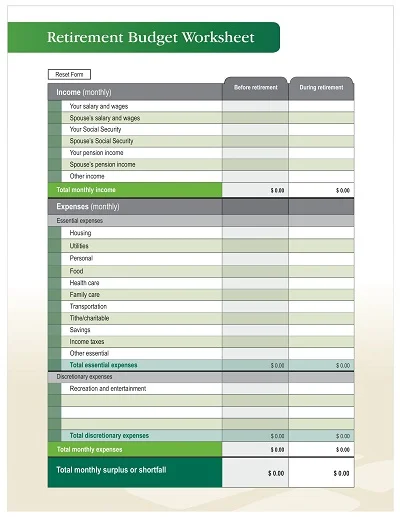

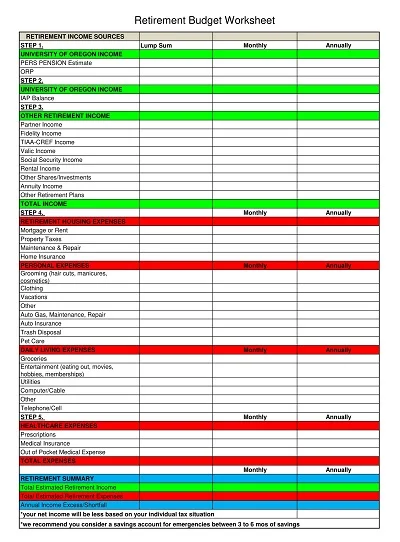

A Retirement budget worksheet template is an invaluable practical tool that has been crafted to enable pre-retirees to plan their income and expenses in retirement effectively. It has an easy-to-use interface when entering numerous possible figures and values, including stable and constant income and undefined and changeable living expenses.

The new format of the template practically can be adjusted using customization features that make it possible to reflect the unique lifestyle and financial goals. It is equally useful for social users as an educational resource to enable them to understand the challenges of retirement finances and make proper decisions. It is crucial for formulating a specific and safe retirement plan for someone.

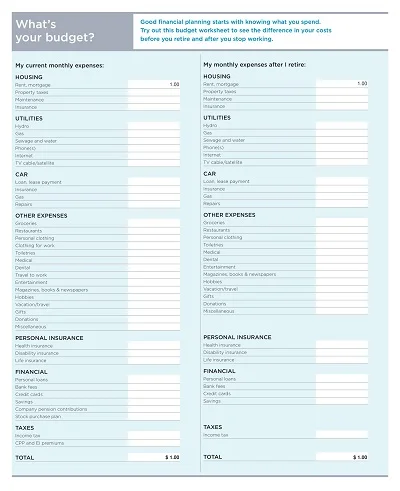

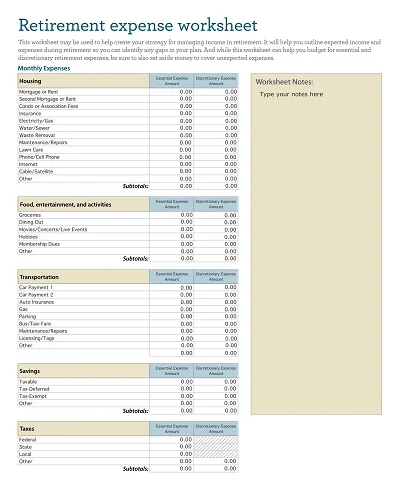

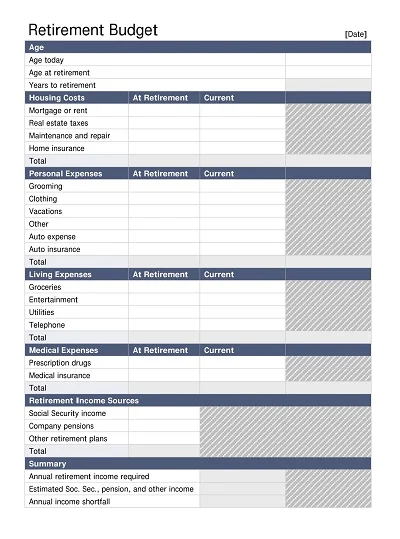

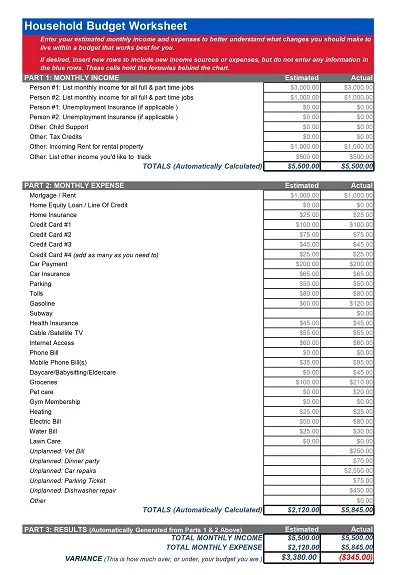

Download Free Sample Retirement Budget Worksheets

What is a Retirement Budget?

A Retirement budget refers to the overall picture of expenditure and income that one must manage after planning to retire. It is intended to serve as a source of funds that will be useful when a person is no longer able to work to gain a salary.

This should include all forms of income retirement pensions, social security, investments, a part-time job, and many more in the same way that the above budget takes into account all cost of living expenses such as; house rent, medical bills, traveling, entertainment, and any other expenditure that may be incurred as one ages. It is a channel used to ascertain that retirement savings will suffice throughout the retirement age and/ or the savings aimed at allowing one to live a comfortable life.

Importance of Budgeting for Retirement

Planning toward retirement is one of the most vital financial planning a person should have in his or her lifetime. Domitrovits & Christy (2015) agree that budgeting for retirement is very important for an individual, particularly for retirement years. Strategic and deliberate retirement planning enables one to set adequate funds for some basic needs like health expenses, which are always a challenge in later ages, and maintain the lifestyle one wants to lead.

This planning encompasses the process and how inflation affects purchasing power in the long run. Heavily nuanced thinking about financing involves care and planning for possible future medical requirements, taxes in retirement accounts, and the likelihood of exhausting all the savings. So it is smart to have a strict numerical budget that invests in various securities to bear the risk capacity and expected expenditures in life but with elasticity to crank up to occasional shocks.

Benefits of Planning Your Retirement Budget

Here are some benefits of Planning Your Retirement Budget:

- Increased financial security: It is good to have a retirement budget so one is not left stranded with no money to fund all the rainy days in the retirement period.

- Better money management: A clear and well-spelled budget assists in day-to-day control and minimizes a person’s probable spending, which would lead to accumulated extra debt.

- Enhanced peace of mind: If you are sure that you have your retirement financially sorted, you will be relieved of your financial stress and hence able to retire happily.

- Opportunities for a more comfortable lifestyle: By having a budget, one is likely to be able to afford leisure, travel, and hobbies that would most definitely not be possible if they had to bear the expenses on their own.

- Preparedness for unexpected expenses: Having a budget for retirement for instance by estimating possible other unseen expenses is essential as it would mean that one cannot face a financial crisis in the future.

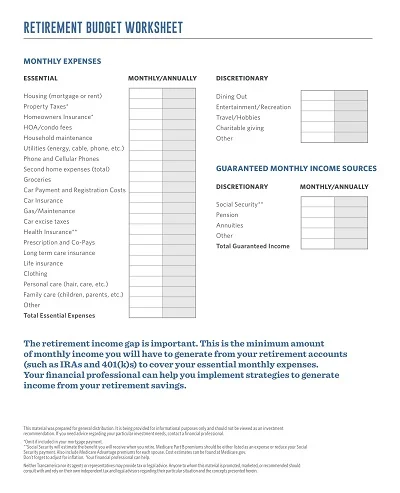

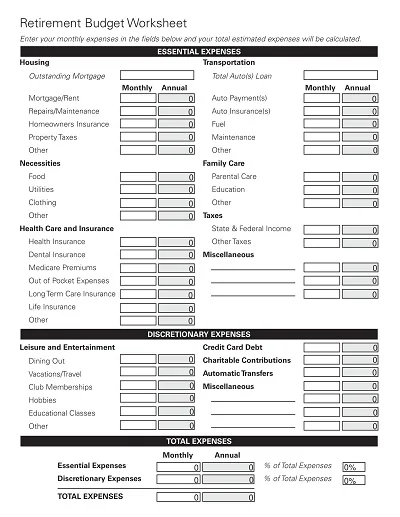

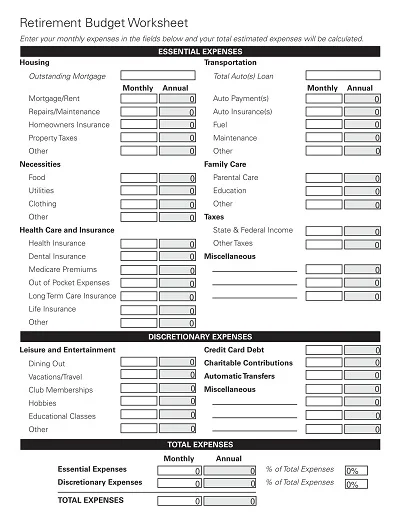

Key Components of a Retirement Budget Worksheet

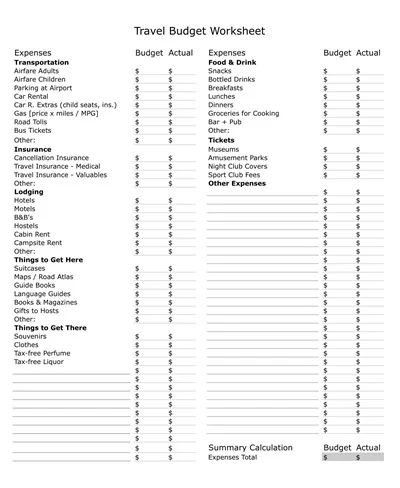

Some key components of a Retirement Budget Worksheet:

1. Housing Costs

- Mortgage or Rent

- Property Taxes

- Homeowners or Renters Insurance

- Maintenance and Repairs

2. Healthcare Expenses

- Medicare or Private Insurance Premiums

- Out-of-pocket Costs

- Prescription Medications

3. Living Expenses

- Groceries

- Utilities

- Transportation

4. Entertainment and Leisure

- Travel

- Dining Out

- Hobbies and Memberships

5. Debts and Obligations

- Credit Card Payments

- Personal Loan Payments

- Other Debt Payments

6. Emergency Fund

- Unexpected Medical Expenses

- Home or Car Repairs

7. Long-Term Savings and Investments

- Savings Account Contributions

- Investment Account Contributions

These subheadings are as follows, some areas on the retirement budget worksheet can enhance a person’s plan for a good retirement.

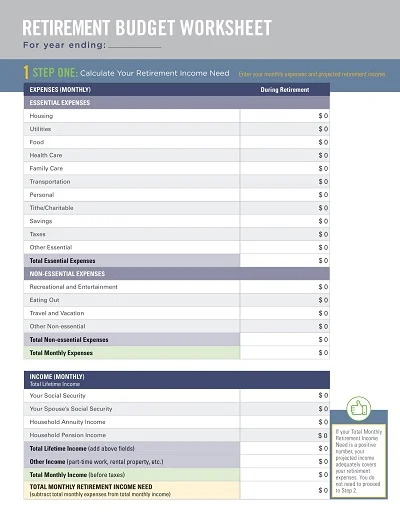

How to Create a Retirement Budget Worksheet

I was also useful in preparing for retirement especially when developing a budget worksheet to understand how you will have to manage your finances.

Here’s how to get started:

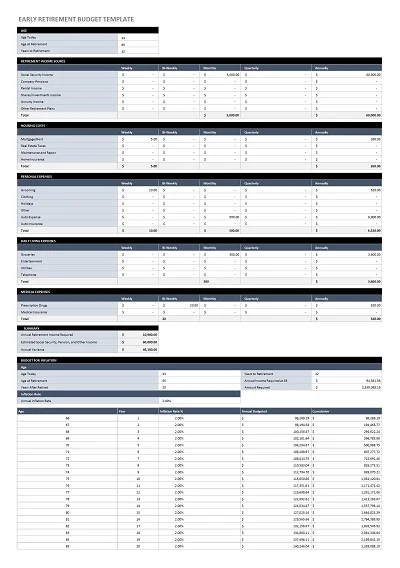

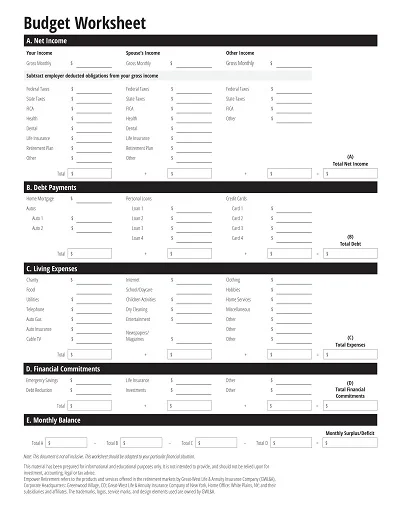

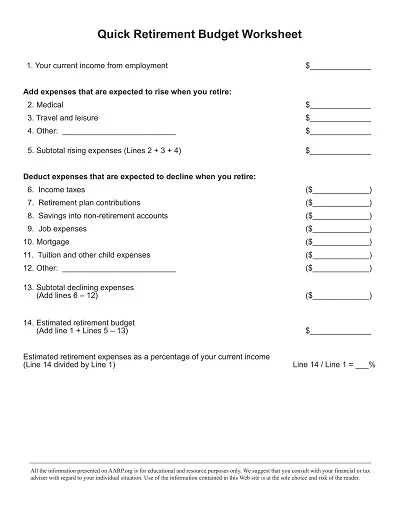

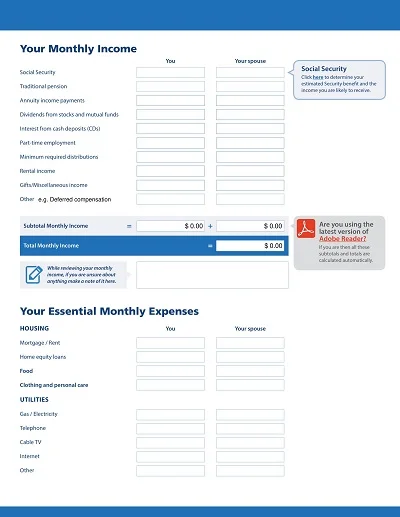

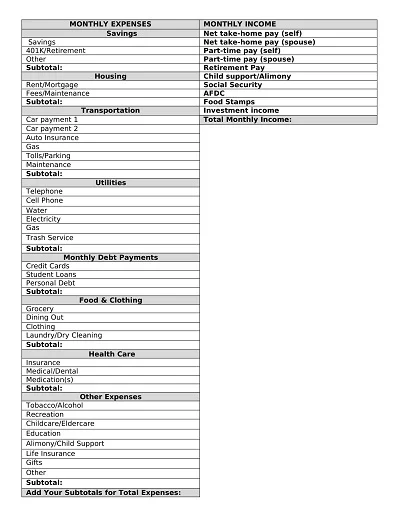

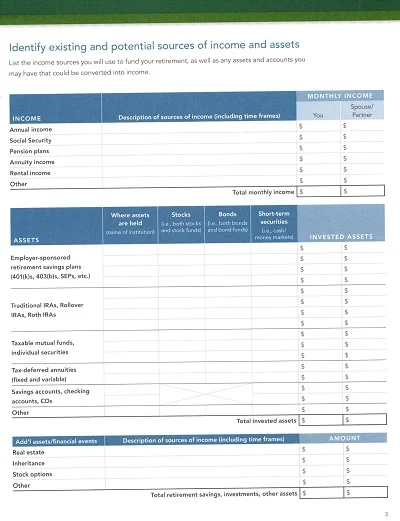

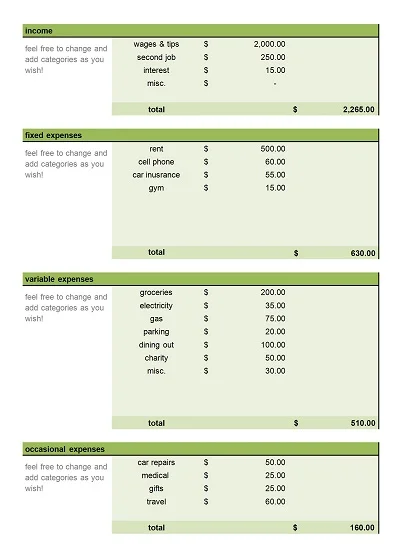

- Determine Income Sources: Gather details of all types of income you have, whether passive or earned through wages: Social Security, pension, investment income, rents, and any part-time employment.

- Estimate Living Expenses: Add up your consumption expenditure and service charges such as rent, light, water, food and beverages, insurance premiums, and medical bills respectively for a month.

- Account for Inflation: The third consideration is the inflation factor, which is the most likely factor for the rising cost of living.

- Plan for Discretionary Spending: It is also important for an individual to cater for the amount of money he or she deserves to spend during his or her leisure time, times of vacations or holidays and other activities such as taking up hobbies during his or her retirement period.

- Consider Health Care Costs: Forecast future costs on health care and ascertain whether this cost has to be incorporated into the budget.

- Prepare for the Unexpected: It is advised that in case there are emergencies that may occur during the time of retirement, money should be saved for the same.