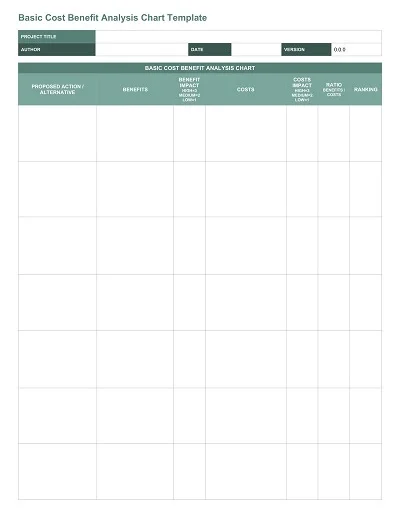

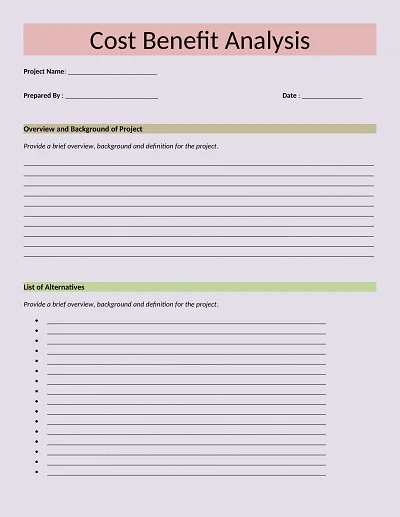

A template for Cost Benefit Analysis (CBA) is a guide that can be used to assess a project’s monetary impacts or decisions. These templates often contain parts that identify the costs and the advantages and a part that determines the net present value.

They could also include spaces for identifying and evaluating qualitative aspects, risks, and assumptions to cover all angles. The purpose is to measure trade-offs and facilitate decision-making for value creation.

Download Free Template For Cost Benefit Analysis

What is a Cost Benefit Analysis?

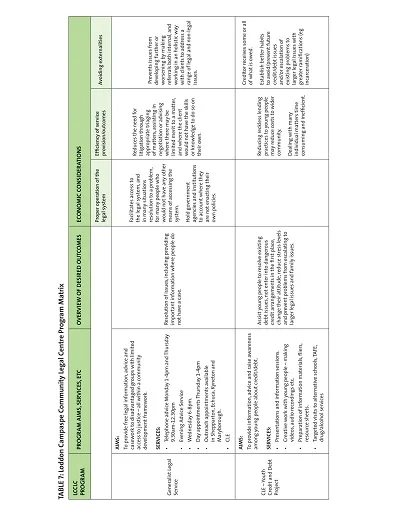

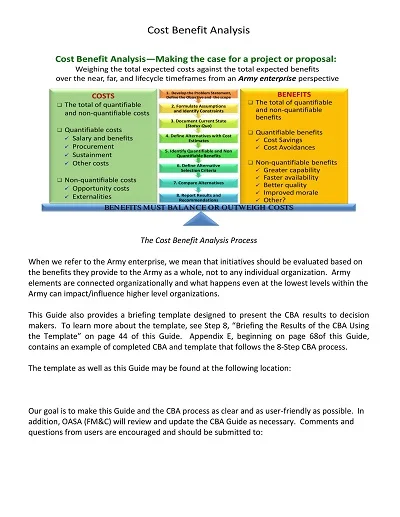

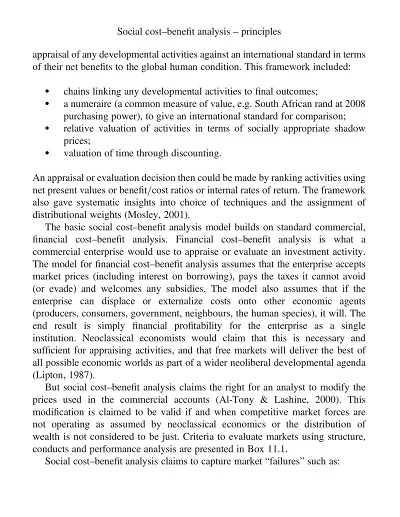

Cost-benefit analysis (CBA) is a technique commonly used in decision-making processes that assesses several choices’ strengths and potential weaknesses. This approach allows the amount of money that can be gained from a particular project or decision to be compared to the costs that come with it.

This assists in the decision-making process that seeks to check the viability of the investment based on financial prospects. With CBA, stakeholders can easily decide which project to fund and how much capital to sink into a given venture since it outlines risks and potential gains.

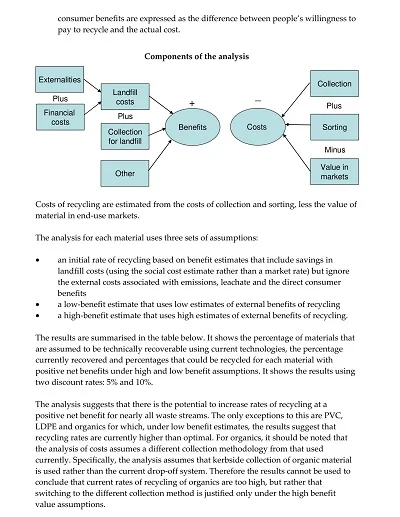

Components of Cost-Benefit Analysis

In conducting a Cost-Benefit Analysis (CBA), several critical components must be carefully considered to ensure a comprehensive evaluation:

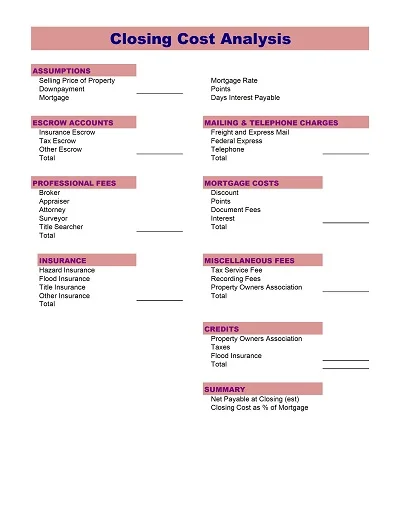

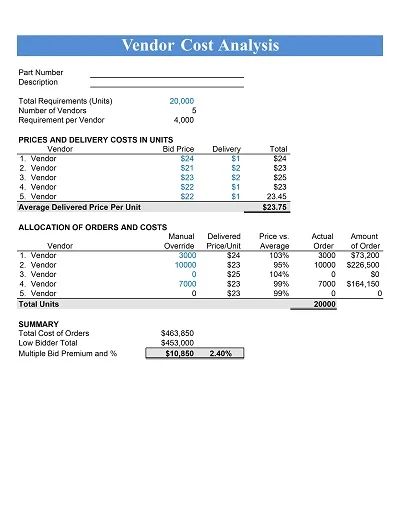

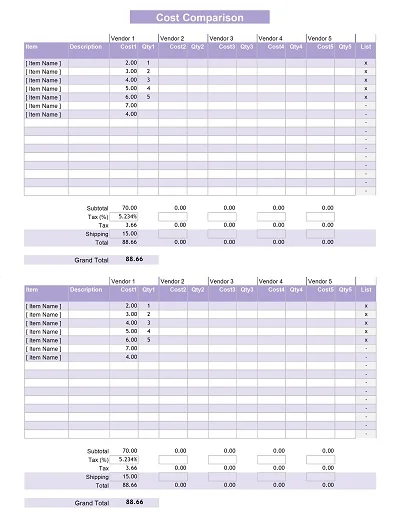

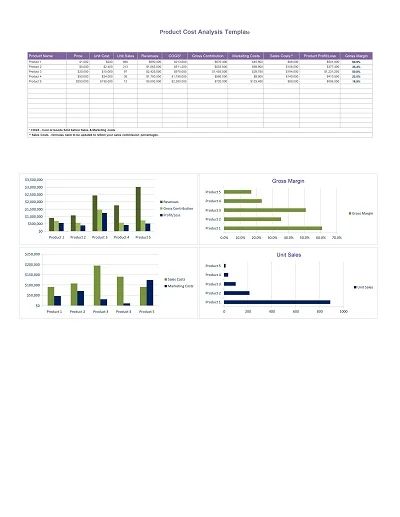

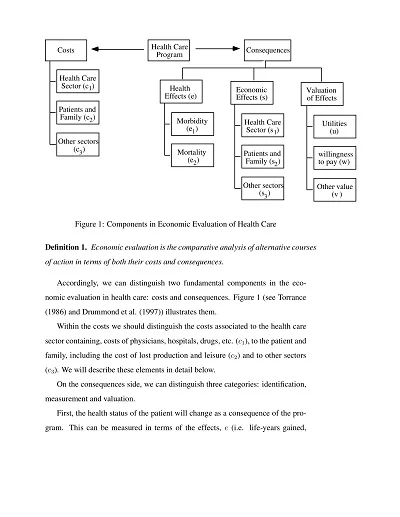

- Identification of Costs: This involves analyzing all the kinds of expenses that may be required for the given campaign, which may comprise the cost of starting up the project, the cost incurred by the organization in the day-to-day operation of the campaign, and the recurrent costs of maintaining the initiative.

- Identification of Benefits: Here, we mentioned all the expected benefits typical for every business or organization, for example, the growth of the number of revenues, the rise of the working efficiency, or any other material and nonmaterial gains.

- Time Horizon: Specifies the time frame for measuring costs and benefits and is highly relevant to distinguishing between long-term and short-term effects.

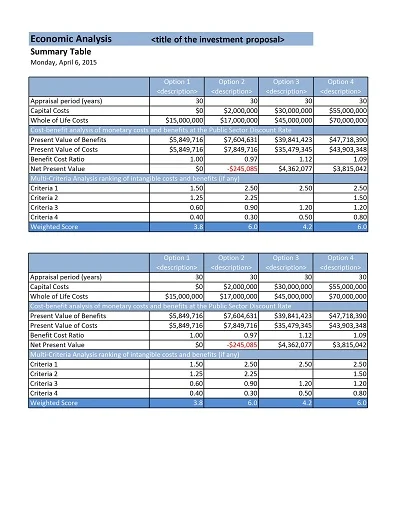

- Discount Rate: This rate helps determine the current value that can be expected from the benefits to be received in the future and the costs that will be incurred.

- Net Present Value (NPV): Thus, the subsequent section introduces the concept of NPV, which defines a definite amount for tangible investment gains and losses by subtracting cost and benefit figures discounted for their present value.

- Sensitivity Analysis: This looks at how the outcome of the CBA will look under shifts in the assumptions; the aspect looks at risks and uncertainties characteristic of the project.

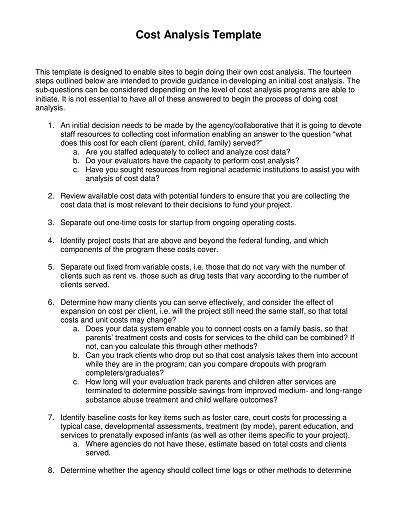

Steps to Conduct a Cost-Benefit Analysis

To conduct a Cost-Benefit Analysis (CBA), follow these systematic steps:

- Define the scope: Describe the project or decision to be made, said objectives, and the expected results.

- List costs and benefits: Identify all possible known economic costs flush with project activities, whether direct or indirect and all possible economic benefits, whether measurable or non-measurable.

- Quantify costs and benefits: Convert costs and benefits into monetary terms based on economic data and feasible approximations.

- Determine the discount rate: If the analysis is performed over time, choosing the appropriate discounting rate consistent with the time value is also recommended.

- Calculate net present value: The overall costs and benefits expected in the future must be brought to their present value, giving you the project’s Net Present Value (NPV).

- Conduct a sensitivity analysis: Check the effect of modifying the main assumptions to determine how ital is vulnerable to fluctuations.

- Make a recommendation: In light of these observations, make a recommendation on whether the implementation of the project is worthy or significant due to the following.

Advantages and Limitations of Cost-Benefit Analysis

Here are some advantages and limitations of Cost Benefit Analysis:

Advantages of Cost-Benefit Analysis

Some essential advantages of Cost Benefit Analysis:

- Economic Efficiency: It enables assessing which of the available options offers the most significant return over a cost, which aids in optimizing resource distribution.

- Informed Decision-Making: CBA is the logical continuation of the life cycle, and it offers a clear structure to support comparison, decision-making, and identifying priorities based on evidence.

- Quantitative Analysis: CBA allows for real trade-offs between options by placing a price tag on efficiency losses.

- Risk Assessment: It can consider such risks and uncertainties to allow. Flexible decision-making according to the existing circumstances that affect the organizations.

Limitations of Cost-Benefit Analysis

Some fundamental limitations of Cost Benefit Analysis:

- Valuation Challenges: Valuing intangible items is a sensitive business, and assigning a dollar sign to factors such as environmental conservation or social responsibility is complex.

- Long-Term Predictions: It can be difficult to forecast future benefits and costs accurately.

- Equity Concerns: On its own, CBA is likely to push for solutions that promote the status quo or majority benefit, leaving out minorities or lower strata society.

- Oversimplification: Cutting down wide effects to measurable monetary value has drawbacks whereby certain eventualities can be easily overlooked or the qualitative aspects overlooked or not given their due attention.

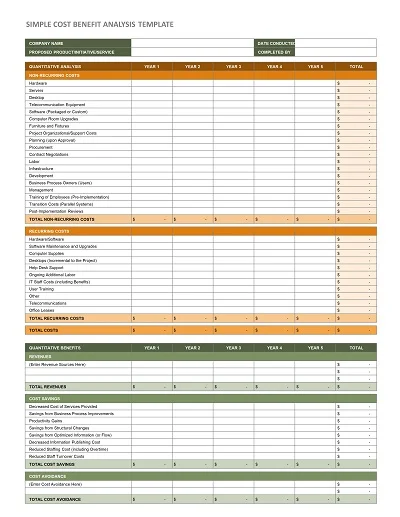

How to Create a Cost-Benefit Analysis Template

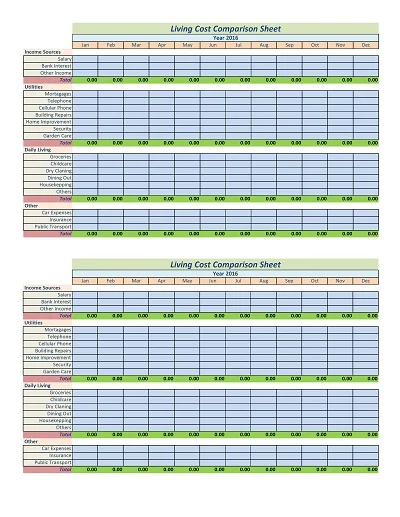

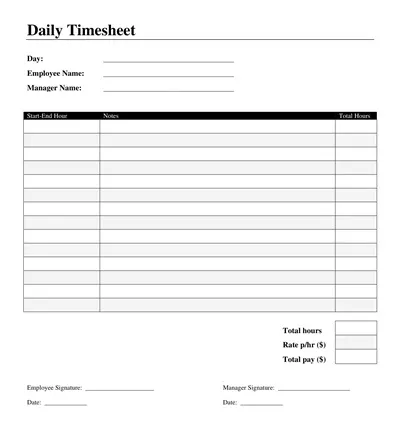

The basic steps to prepare the Cost-Benefit Analysis (CBA) template include laying down a plan on the Excel worksheet and dividing it into various segments that would help document a particular venture’s cost and benefit aspects.

Here’s a simple breakdown of the sections to include:

- Project Justification – A summary of reasons for undertaking the project and selecting the research approach.

- Cost – Identify all the expenses related to the given project, from expenses for its initialization to those incurred continually. These can be the capital costs involved in establishing the facility, the daily running costs, and the frequency incurred in maintaining the facility and the equipment within it.

- Benefit Assessment – This is the last step of the analysis process, where details should be provided about the benefits to be enjoyed in a given project or any set of activities to be implemented. These may be often identified in financial or tangible terms and include the following:. This can be revenues, cost reductions, non-financial benefits, and any other ripple effects, positive impacts, or returns that are not measurable in the short term.

- Time frame – Specify how costs and benefits will be realized while undertaking an activity. This could be months, years, or the project’s expected existence. For example, if a project is expected to run for one year, then the timeframe could be one year.

- Discount Rate – This is an algebraic rate whereby the current value of any amount or currency is reduced by a set rate to allow for its time value.

- Discounting of cash flows – Determines the overall NPV of benefits vs costs of a project to come up with the benefit of investing in the project.

- Sensitivity Analysis – The uncertainties involved with the variable changes should also be reflected in the Specific recommendation, where a sensitivity analysis should also be made dependent on the estimates.

- Recommendation – This is the final part of the CBA to encapsulate the general conclusion of the entire study, to be directed to the appropriate decision-makers, together with justifications for choosing the CBA recommendation.

Please ensure that the template is designed to accept the costs and benefits information in a clear and concise manner, with parts where mathematical formulas can be input for use in the calculation of results of the different factors.

The following is a structured approach toward decision-making as part of conducting a CBA Decision: This approach towards the CBA decisions will maintain coherence throughout the decision-making process.