A proof of funds letter template provides the right format for organizing the content of a letter that will act as a formal way of proving sufficient funds or capital in any transaction. This document is usually utilized in the buying or selling of houses or other properties, investments, or other business transactions that call for certainty regarding adequate working capital.

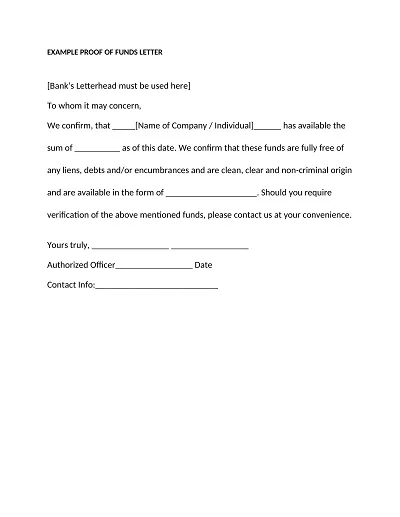

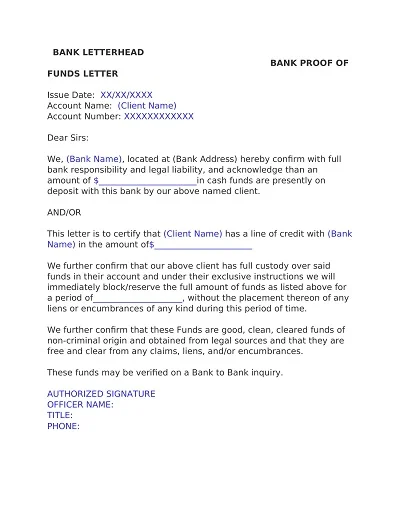

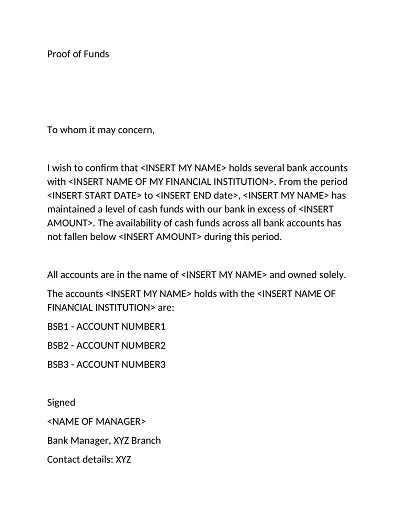

It may contain the account holder’s name, the bank’s name, the date, the account balance, and a statement from the bank concerning the available funds. It is a vital determinant in transactions since it provides evidence of the financial capacity of the parties involved in the proposed transaction.

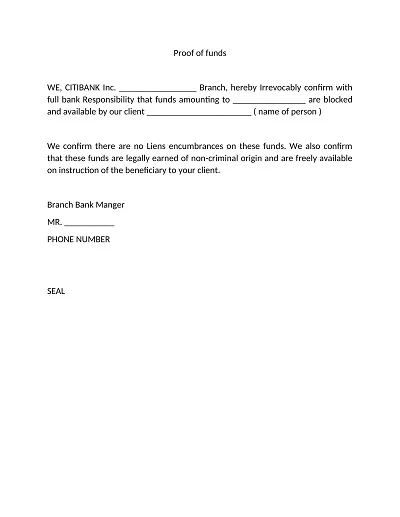

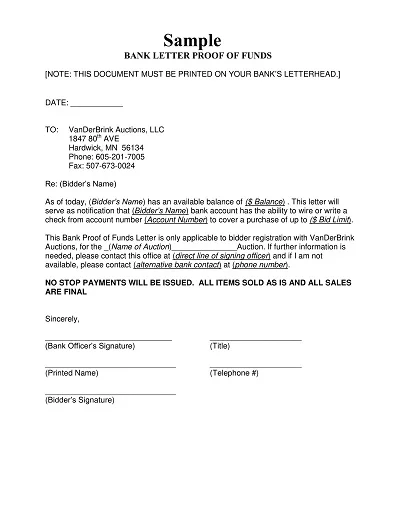

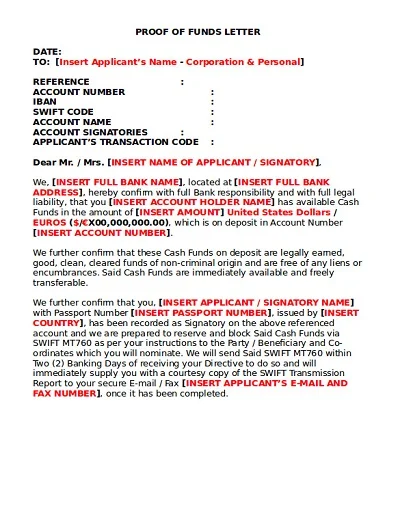

Download Free Sample Proof of Funds Letter Templates

What is a Proof of Funds Letter?

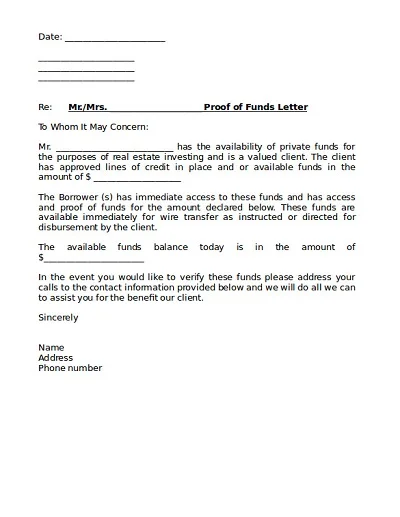

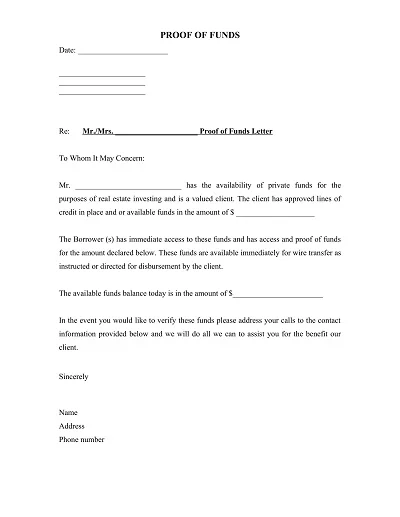

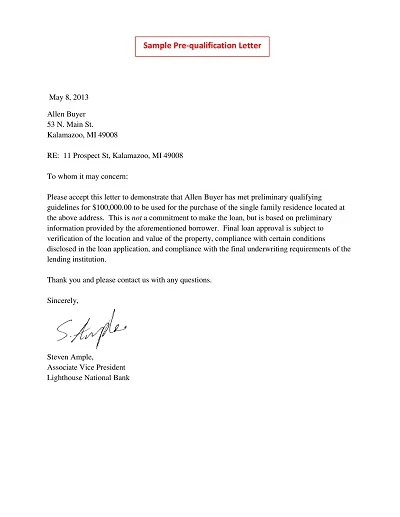

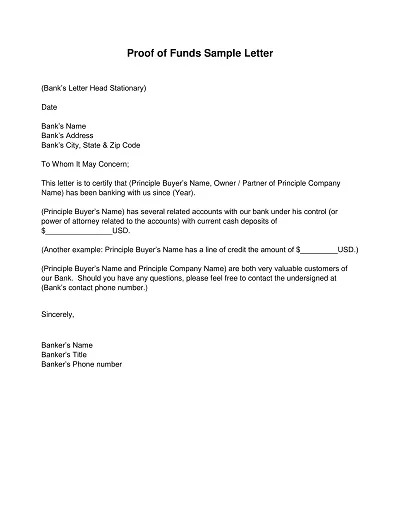

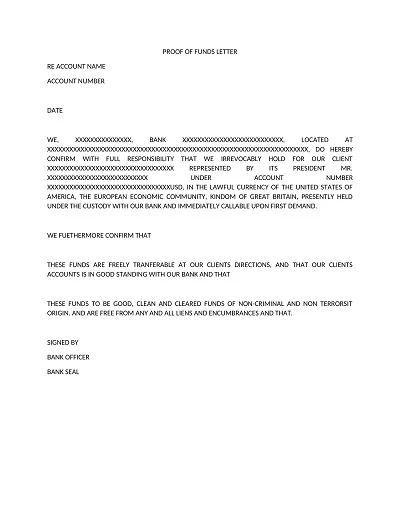

A Proof of Funds (POF) Letter confirms that an individual or company can finance a certain transaction. It is commonly used in real estate transactions, and it consists of a copy of statements from a bank branch or a letter from the financial institution confirming the buyer’s ability to pay for the property.

This document is important for the sellers to be assured that the prospective buyer has the relevant cash, reducing the insecurity. It is a testament to the buyer’s financial strength and a crucial element that may help speed up the buying process by assuring the transaction from the viewpoint of its financial realism.

Types of Proof of Funds Letters

Proof of Funds (POF) letters are necessary in various deals, especially real estate, to ensure that the purchaser has enough funds. Below are different forms of Proof of Funds letters:

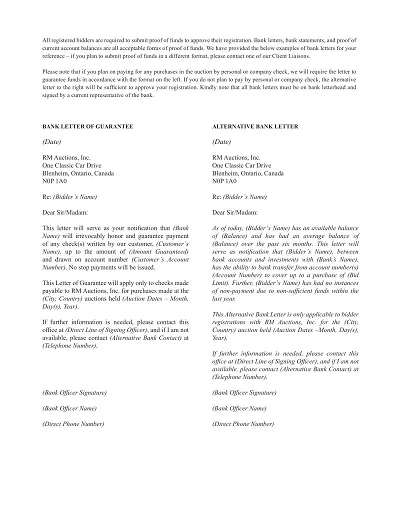

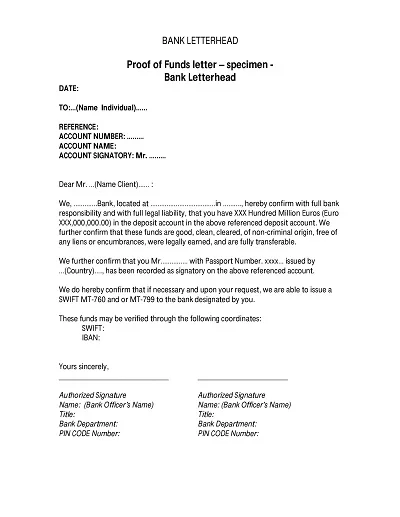

Bank Comfort Letters (BCL)

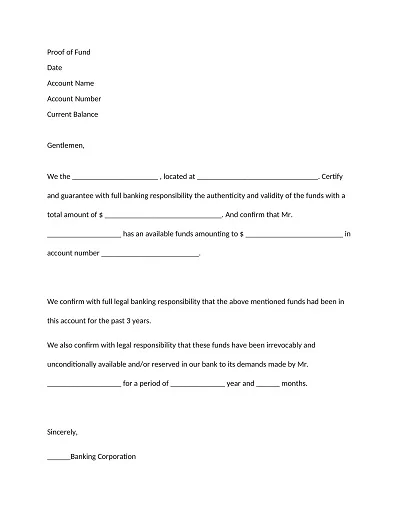

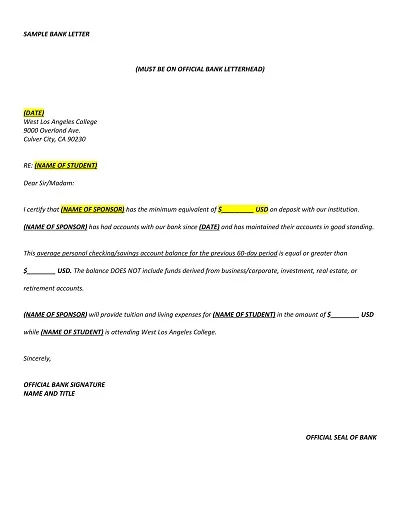

The bank issues a Bank Comfort Letter to assure its clients that they have enough funds in their accounts. BCLs are frequently utilized in international trade transactions to guarantee the buyer’s financial position.

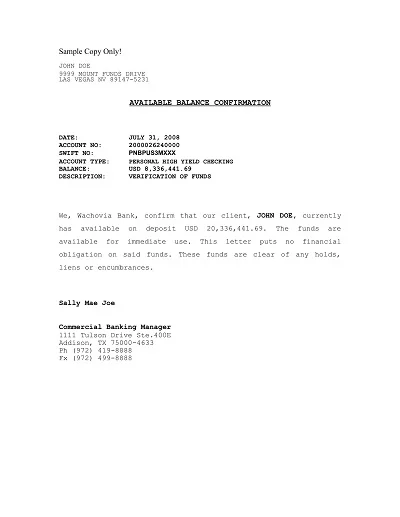

Verified Account Statements

These usual bank statements have been confirmed by the bank to ascertain the account holder’s balance within a given period. They are simple and widely accepted, showing the availability of funds but not delving into details about an account holder’s financial history.

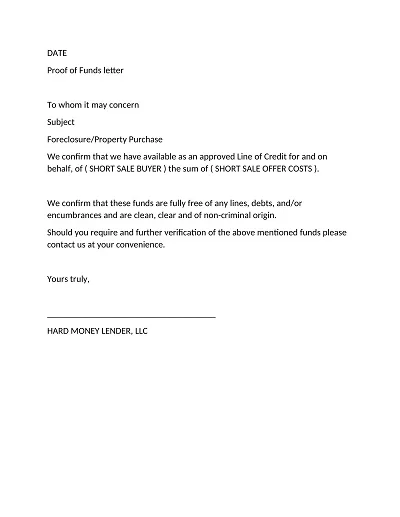

Escrow Verification Letters

While performing due diligence on real estate properties, such a letter is required to secure property under contract situations where an escrow account is utilized. The letter shows that the buyer put money in an escrow account for this deal, which will remain there until completion. Therefore, it can be considered proof of fund receipt from the buyer’s side for real estate transactions requiring escrow arrangements.

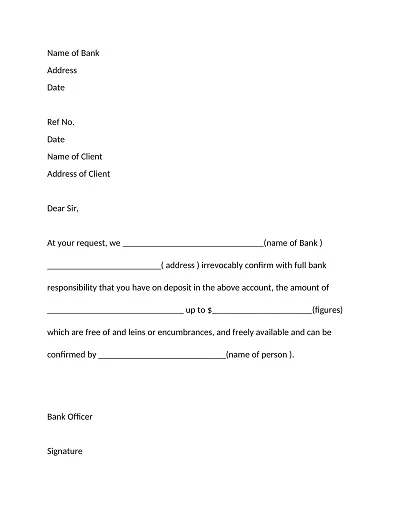

Elements That Should be Included In a Proof of Funds Letter

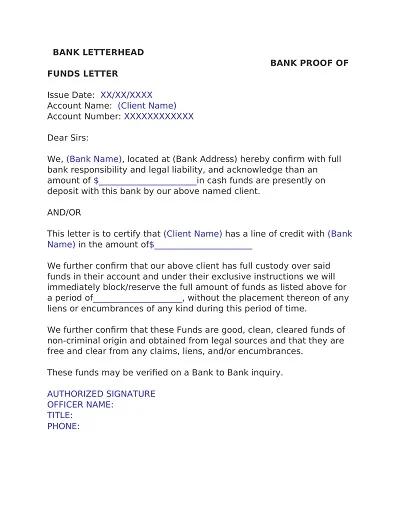

For instance, in securing real estate deals or business contracts, including certain elements in a Proof of Funds (POF) Letter is essential. Here are some things that should be included in this letter:

- Date: This should reflect the current nature of the letter.

- Bank’s Name and Address: Identification particulars of the bank that issued it or the financial institution that gave this money.

- Client’s Name: The person whose account funds have to be verified.

- Balance Statement: A statement indicating enough money for any transaction under discussion.

- Bank’s Statement: An official statement validating an account together with the availability of its finances

- Bank Contact Information: Provide details about contacting your bank to facilitate verification by the recipient.

- Signature: The bank officer signing it must be authorized to sign such documents.

This letter has to adhere to an appropriate manner, bear a bank logo, and thus appear authentic and useful.

Common Mistakes for Proof of Funds Letters

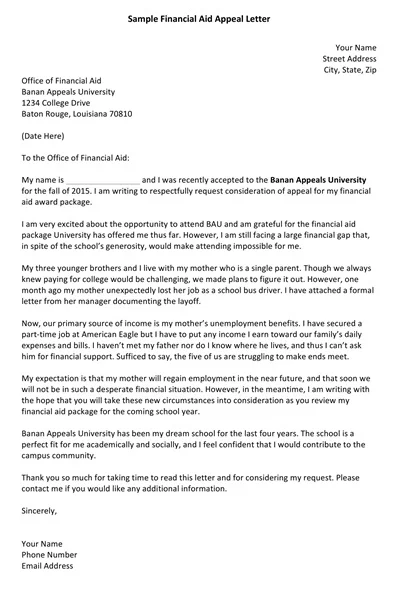

There are several common mistakes that someone preparing a proof of funds (POF) letter may make. One of the most critical is failing to specify the account holder’s name, which calls into question whether or not they are even real. Another is failing to include the date since it could make the document look outdated, especially in situations where the timing for the availability of funds matters.

Further, using a template that doesn’t match either formal requirements or the recipient’s expectations can result in misunderstandings or rejections. Most importantly, one must ensure that the letter is issued and signed by a reputable bank or financial institution; this will adversely affect its authenticity and usefulness. It is important to avoid these pitfalls during verification so as to have a smooth and successful process.

Why Do You Need A Proof Of Funds Letter?

In many financial and real estate transactions, a Proof of Funds (POF) letter is a crucial instrument that provides evidence of an individual or company’s capability to execute an intended purchase or investment.

Here are vital reasons detailing its necessity:

Secures Trust in Transactions

A POF letter helps overcome distrust in the transactions, especially in real estate or large-scale investments, since the buyer signs the document to prove that they have enough money to purchase. It is especially useful in competing industries or those that require a fast turnover of deals.

Facilitates Smooth Deal Progression

This way, presenting a POF letter reduces the possibility of a transaction stalling due to the validation of financial credentials. It assures the seller of seriousness from the buyer side, making them prefer such a buyer’s offer over other prospective buyers.

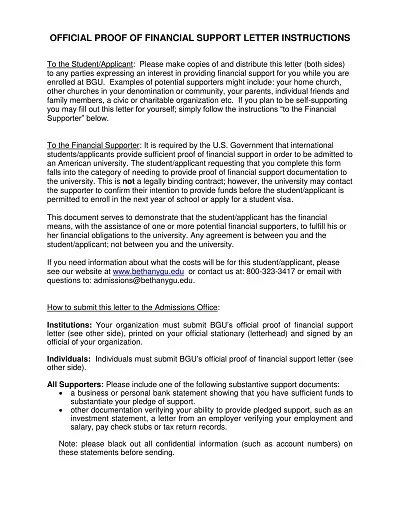

Compliance and Regulatory Requirements

It should also be noted that in some cases, a POF letter can be necessary to the regulating authority or following the law. This is especially so where the transaction involves a large number or where the counterparty is in another country.

Enhances Negotiation Position

A buyer with a POF letter is in a better position to negotiate deals since they can show the seller that they have the financial capacity to make the deal. This can prove useful, especially when direct bargaining with the sellers or bidding for products through an auction.

Prevents Financial Overextension

It also provides a seemingly self-check mechanism for buyers to ensure they do not overcommit themselves when they obtain a POF letter. Purchasers’ verification of their finances is an effective way to prevent buyers from being blinded by loving eyes into making unwise financial decisions.

Do’s and Dont’s in Proof of Funds Letter

So, to be clear, here are some do’s and don’ts when it comes to proof of funds letter. They assist in minimizing mistakes that could make the letter look fake and raise the possibility of one obtaining approval on an application or being accepted.

Do’s in a Proof of Funds Letter:

- Ensure Accuracy: Make sure all the information in the letter is up to date and correct. This comprises the account holder’s name, the account number, if any, and the amount in the account.

- Official Documentation: For authenticity, the letter must be written on the bank’s letterhead so as to effectively demonstrate the organization’s name and contact details.

- Bank’s Contact Information: Make sure to include specific banking contact information for the bank representative issuing the letter so that others can verify if necessary.

- Date the Letter: The letter should be current and provide information on the applicant’s/borrower’s financial position at the time of the application or transaction.

Don’ts in a Proof of Funds Letter:

- Avoid Editing or Alterations: Once the bank has given out the letter, it is wise not to attempt to alter it in any way. Even if the surface is merely scratched, signs of tampering can cancel the document’s validity.

- Do Not Use Outdated Information: It is also crucial not to provide a proof of funds letter containing old or outdated information, as this is likely to cause problems for your application.

- Don’t Forget to Verify: After completing the payment slip, ensure that all other details are well captured, particularly the amounts indicated.

- Do Not Withhold Information: When certain transactions or balances of several accounts need to be disclosed, it is crucial to include all the data necessary to avoid certain issues.

How to Write a Proof of Funds Letter Template

To create a Proof of Funds Letter, follow these detailed steps:

- Gather Necessary Information: To write an effective letter, ensure you acquire complete details such as your bank details, the amount of money available, and the contact of a bank official to deal with.

- Introduction Section: First, write the date at the beginning of the letter before you start typing. Following the date, state your full name and proceed to include your contact details beneath it. Lastly, provide the name and contact details of the intended recipient by indicating the name of the real estate agent, the property seller, or the concerned party to whom the letter is being written.

- Statement of Proof Section: Begin this section by stating the reason for the letter, which is to affirm the availability of adequate funds for a particular transaction. State the sum you have at your disposal, guaranteeing that it covers or surpasses the amount necessary to fulfill the specific transaction.

- Bank Details Section: Enter the full name of your bank. Special attention must be paid to this data’s reliability to verify the funding sources’ authenticity. However, it is important not to disclose the account number or any other sensitive information that may compromise an individual’s financial status.

- Bank Contact Information Section: Include the name, position title (for example, Branch Manager), and contact information of a bank official who can confirm the contents of this letter. This might include a phone number and/or an email address.

- Closing Section: End your letter with an official remark restating your eagerness to proceed with the transaction. A polite closing should follow, followed by your signature and your name typed under the signature line. If you did not sign the end of the letter with a date, you may choose to place the date of signing either aside or below the signature.

- Proofreading and Verification: Before sending the letter, review all the information provided to ensure its correctness and the absence of typographical errors. It may also be wise for the bank official to finally read through the letter to ensure that all the details mentioned therein are well-contained and in order.

By following these detailed procedures, you will produce a clear and well-coordinated Proof of Funds Letter for any transaction that requires evidence of the ability to generate funds.