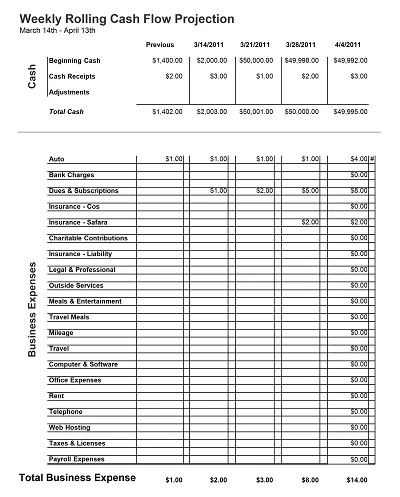

Rolling Forecast Template is a continuously updated financial model that lets companies forecast results using the most recent input, unlike a Fiscal Year’s rigid limitation.

It goes beyond the ordinary premise of a budget, which only lasts until the closure period of accounts; rather, it gets updated monthly or quarterly as time progresses. It provides more realistic predictions and better decision-making during evaluation, considering more realistic financial performance or market environment.

Download Free Rolling Forecast Templates

What is a Rolling Forecast?

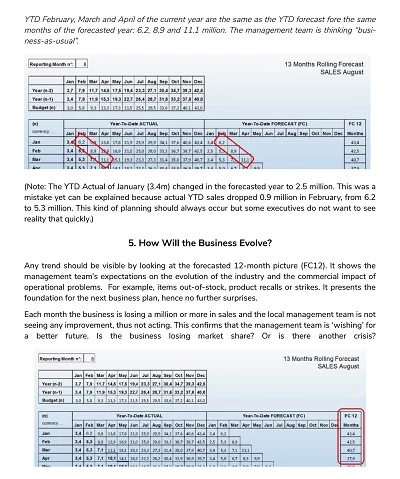

A Rolling Forecast is an FP technique of adjusting planning schedules that extend the frequency of the forecast period by a certain period of time (i.e., quarters or months) when the preceding period’s results have been reported.

Unlike traditional static budgets of the financial year, rolling forecasts are dynamic and that too in tune with the rapid world of the business environment, They give a more up-to-date picture of the expected financial performance of the company and, thereby, are better in terms of allowing management to make necessary changes in strategy and operations.

Significance of Rolling Forecast

Rolling forecasts are a forward planning procedure that retains the forecast horizon by adding one more period (for example, a month or quarter) to the total as soon as the current one is over. This method provides a constantly changing planning environment that is most favourable to the business.

Benefits of Rolling Forecast

Here are some essential benefits of Rolling Forecast:

- Increased Flexibility:

- Adjusts better to changes that are bound to occur in the market.

- Facilitates the ability to build responsiveness and adaptability by shifting resources to capitalise on new opportunities or threats.

- Enhanced Accuracy:

- Reduces chain concentrating on fixed annual financial budgets, often called the ‘anchor’ effect.

- Based on more current data, it is more likely to be predictive.

- Better Decision Making:

- This supports a flexible-oriented culture, or in other words, a culture that encourages organizational responsiveness.

- Supplies it with the newest trends in data and knowledge to facilitate strategic decisions.

- Strategic Alignment:

- Leads to increased coordination of organizational goals across the various departments within the company.

- Helped stabilize strategic direction while addressing day-to-day issues.

- Cost Efficiency:

- Helps identify wasteful expenditures.

- Practical in terms of improving financial resource management.

Critical Components of Rolling Forecast

One of the significant features of the decisive role of rolling forecasts is that they are carried out regularly. Critical components of a rolling forecast include:

- Time Horizon: An average rolling forecast will cover a particular horizon, always the next period, for example, one year or up to eighteen months and is usually reviewed at fixed intervals like monthly or quarterly.

- Data Integration: Accomplishes the goal using archival and current data to provide the highest possible degree of relevancy.

- Business Drivers: Recognising and evaluating major drivers that shape business operations and prospects for future development.

- Scenario Planning: This arises from establishing numerous ‘Simulated End-use Models’ to analyze potential future states.

- Flexible Design: The flexibility for frequent adjustments of the forecast to capture changes in the business environment without necessarily having to reformulate the forecast completely.

- Performance Metrics: Employ a measure comprising the number and non-number type related to the firm’s strategy.

- Technology: Particularly, the use of forecasting software permits the implementation of programmes for the efficient gathering, analysis, and presentation of data.

Advantages of Rolling Forecast

Here are some common advantages of Rolling Forecast:

Enhanced Flexibility

Dynamic planning enables the organisation to respond more to environmental changes than traditional financial forecasting. While a fixed budget remains unchangeable for the entire fiscal year, a rolling budget is subject to change and provides businesses with the opportunity to adapt to market conditions and business processes in the most efficient way possible.

Improved Accuracy

Compared with traditional budgets, rolling forecasts are completed more often and thus regarded as more accurate. It also aids the company in its decision-making process on investments, costs and strategic planning since more precise and refined figures can be obtained.

Strategic Decision Making

That is why the regularity of these forecasts needs to be high, as it will empower the decision-maker to manage the organisation ahead of time rather than wait for things to go wrong. Rolling forecasts provide the backdrop for discussions regarding operational priorities and resource allocation changes towards sectors with the most favourable return rates.

Operational Efficiency

Thus, expectations are likely to be more aligned with actual performance. Since rolling forecasts employ continuous updating, the resultant performance shortfalls can be identified and addressed quickly. These assessments also focus on the effectiveness of business processes and ways of minimizing costs by avoiding formulating unnecessary, repetitive, or inefficient procedures.

Better Stakeholder Engagement

Automatically rolling the forecast increases transparency and coordination between stakeholders since the data is regularly updated. Its financial gives frequent discussions help obtain buy-in from stakeholders and provide a culture of ownership and responsibility regarding its financial status.

Importance of Rolling Forecast in Modern Business

Rolling forecasts are the most valuable tool in the latest economic environment characterized by high competition, flexibility, and uncertainty. This is in contrast to other traditional methods of budgeting that focus on time horizons and periods of time, among them being a fiscal year, rolling forecasts type of budgeting is more responsive to the existing business environment.

They provide the opportunity to fine-tune revenue and profitability expectations, thus enabling organizational strategies to be continually readjusted to reflect the current state of the market environment, competitors and available economic data. This flow means improved decisiveness and stated resource utilisation and can greatly improve a firm’s capability in dealing with change.

How to Create a Rolling Forecast Template

To create a rolling forecast template, follow these steps:

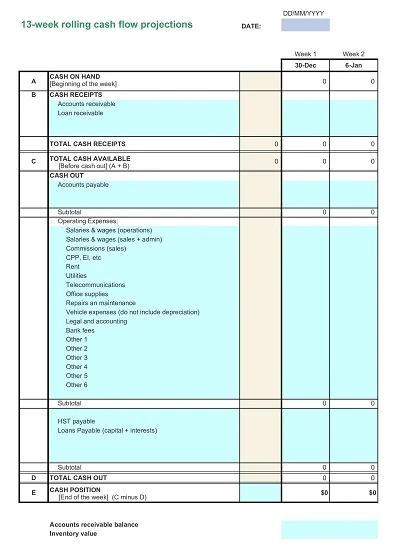

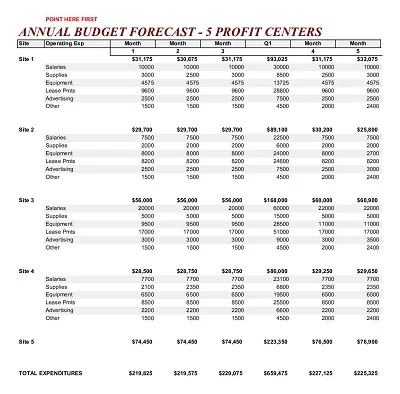

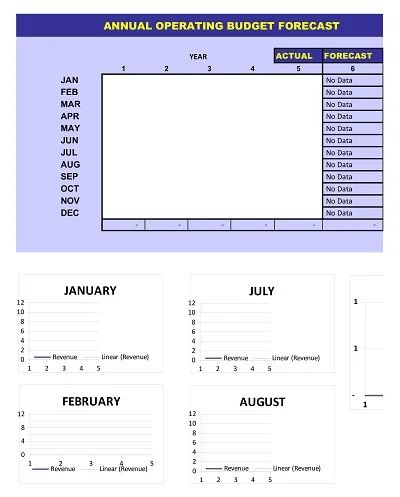

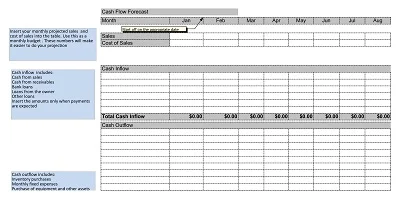

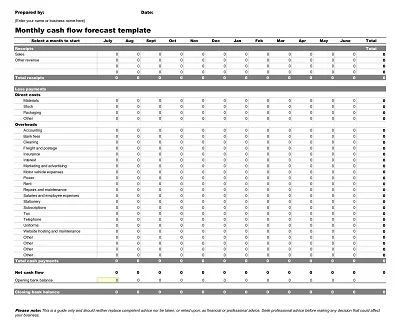

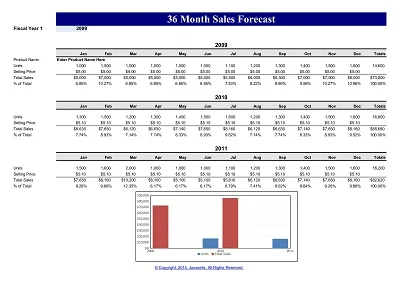

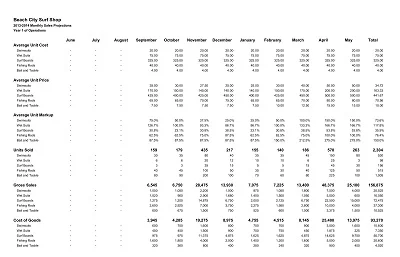

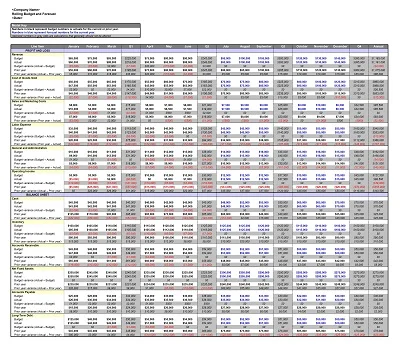

- Start with a Basic Structure: Introduce familiar and convenient Microsoft Excel methodology, and create a template with periods in the top row and various accounts at the side; they can be revenues, costs, and other essential criteria.

- Define Time Frames: Choose the months the rolling forecast would cover; standard time frames are 12 or 18 months, after which the initial month is dropped and the next month added as a new period and configure the respective columns. Set your plans for updating the forecast, and it can be every month or every year, depending on the organization’s needs.

- Input Historical Data: Enter raw data for at least five prior years to benchmark your forecast. This will also assist in finding trends and cycles in operations since the continual monitoring of results is necessary if there are fluctuations.

- Establish Variables: While exercising the checked model, you must choose which factors are variable (changeable) and set them in your template to make necessary modifications quickly.

- Add Formulas: This means calculating core financial numbers, such as total sum and prevalent growth rates. This will automatically make the forecast change as data that has been put as input is altered.

- Implement Conditional Formatting: Apply conditional formatting to obtain concentrated attentiveness to the contrast between an actual and forecast number.

- Create a Dashboard (Optional): Design a clear-cut dashboard to make calculations easily understandable and have the first glimpse of the key indices from the formulated rolling forecast.

- Test the Template: To double-check if your templates work well, review a few examples, ensuring that all your formulas are correct and the template is doing what it should be.

- Incorporate Buffer for Uncertainties: Opt for an extra category or margin if prospective variation or disparity exists in the forecast.

With these bullet points, you can develop a rolling forecast template that enables active and perpetual business modelling.